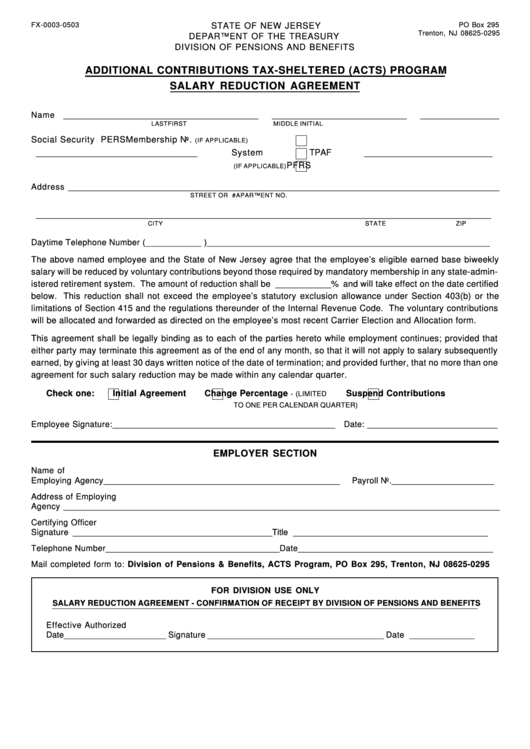

Form Fx-0003-0503 Additional Contributions Tax-Sheltered (Acts) Program Salary Reduction Agreement

ADVERTISEMENT

FX-0003-0503

PO Box 295

STATE OF NEW JERSEY

Trenton, NJ 08625-0295

DEPARTMENT OF THE TREASURY

DIVISION OF PENSIONS AND BENEFITS

ADDITIONAL CONTRIBUTIONS TAX-SHELTERED (ACTS) PROGRAM

SALARY REDUCTION AGREEMENT

Name

__________________________________________

_____________________________

_________________

LAST

FIRST

MIDDLE INITIAL

Social Security No.

Retirement

PERS

Membership No.

(IF APPLICABLE)

__________________________________

System

TPAF

___________________________

PFRS

(IF APPLICABLE)

Address _____________________________________________________________________________________________

STREET OR R.D.#

APARTMENT NO.

________________________________________________________________________________________________

CITY

STATE

ZIP

Daytime Telephone Number ( ____________ ) _____________________________________________________________

The above named employee and the State of New Jersey agree that the employee’s eligible earned base biweekly

salary will be reduced by voluntary contributions beyond those required by mandatory membership in any state-admin-

istered retirement system. The amount of reduction shall be ____________% and will take effect on the date certified

below. This reduction shall not exceed the employee’s statutory exclusion allowance under Section 403(b) or the

limitations of Section 415 and the regulations thereunder of the Internal Revenue Code. The voluntary contributions

will be allocated and forwarded as directed on the employee’s most recent Carrier Election and Allocation form.

This agreement shall be legally binding as to each of the parties hereto while employment continues; provided that

either party may terminate this agreement as of the end of any month, so that it will not apply to salary subsequently

earned, by giving at least 30 days written notice of the date of termination; and provided further, that no more than one

agreement for such salary reduction may be made within any calendar quarter.

Check one:

Initial Agreement

Change Percentage

Suspend Contributions

- (LIMITED

TO ONE PER CALENDAR QUARTER)

Employee Signature: ________________________________________________

Date: ____________________________

EMPLOYER SECTION

Name of

Employing Agency ___________________________________________________

Payroll No. ______________________

Address of Employing

Agency ______________________________________________________________________________________________

Certifying Officer

Signature ___________________________________________

Title __________________________________________

Telephone Number ____________________________________

Date __________________________________________

Mail completed form to: Division of Pensions & Benefits, ACTS Program, PO Box 295, Trenton, NJ 08625-0295

FOR DIVISION USE ONLY

SALARY REDUCTION AGREEMENT - CONFIRMATION OF RECEIPT BY DIVISION OF PENSIONS AND BENEFITS

Effective

Authorized

Date ______________________ Signature ______________________________________ Date ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2