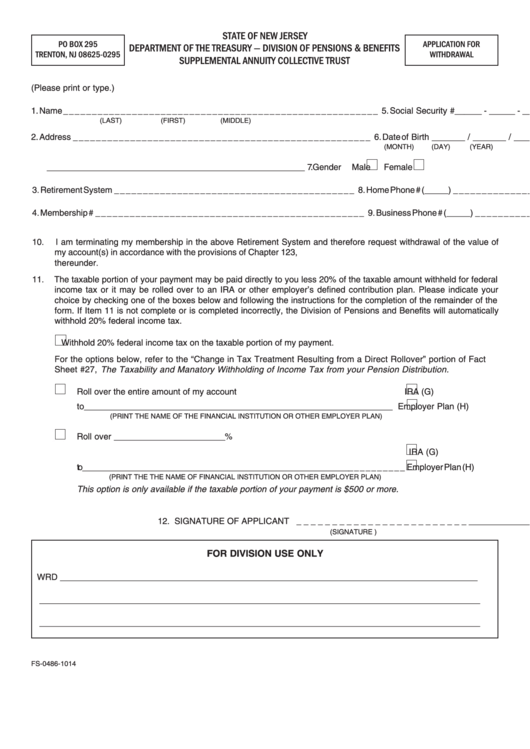

Form Fs-0486-1014 Supplemental Annuity Collective Trust Withdrawal Application

ADVERTISEMENT

STATE OF NEW JERSEY

PO BOX 295

APPLICATION FOR

DEPARTMENT OF THE TREASURY — DIVISION OF PENSIONS & BENEFITS

TRENTON, NJ 08625-0295

WITHDRAWAL

SUPPLEMENTAL ANNUITY COLLECTIVE TRUST

(Please print or type.)

1. Name _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 5. Social Security #______ - ______ - ________

(LAST)

(FIRST)

(MIDDLE)

2. Address _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 6. Date of Birth _______ / _______ / _______

(MONTH)

(DAY)

(YEAR)

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 7. Gender

Male

Female

3. Retirement System _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 8. Home Phone # (_____) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4. Membership # _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ 9. Business Phone # (_____) _ _ _ _ _ _ _ _ _ _ _ _ _ _

10.

I am terminating my membership in the above Retirement System and therefore request withdrawal of the value of

my account(s) in accordance with the provisions of Chapter 123, P.L. 1963 and the rules and regulations promulgated

thereunder.

11.

The taxable portion of your payment may be paid directly to you less 20% of the taxable amount withheld for federal

income tax or it may be rolled over to an IRA or other employer’s defined contribution plan. Please indicate your

choice by checking one of the boxes below and following the instructions for the completion of the remainder of the

form. If Item 11 is not complete or is completed incorrectly, the Division of Pensions and Benefits will automatically

withhold 20% federal income tax.

Withhold 20% federal income tax on the taxable portion of my payment.

For the options below, refer to the “Change in Tax Treatment Resulting from a Direct Rollover” portion of Fact

Sheet #27, The Taxability and Manatory Withholding of Income Tax from your Pension Distribution.

Roll over the entire amount of my account

IRA (G)

to _________________________________________________________________

Employer Plan (H)

(PRINT THE NAME OF THE FINANCIAL INSTITUTION OR OTHER EMPLOYER PLAN)

Roll over __________________________ %

IRA (G)

to _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Employer Plan (H)

(PRINT THE THE NAME OF FINANCIAL INSTITUTION OR OTHER EMPLOYER PLAN)

This option is only available if the taxable portion of your payment is $500 or more.

12. SIGNATURE OF APPLICANT _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(SIGNATURE )

FOR DIVISION USE ONLY

WRD ______________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________

FS-0486-1014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1