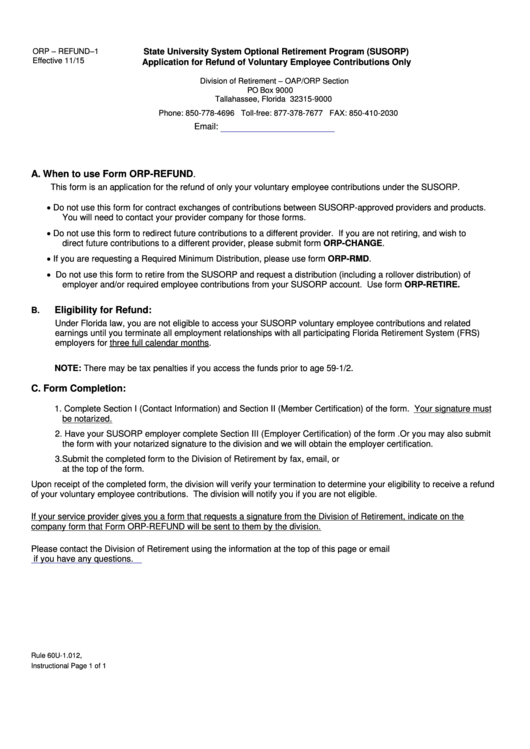

ORP – REFUND–1

State University System Optional Retirement Program (SUSORP)

Effective 11/15

Application for Refund of Voluntary Employee Contributions Only

Division of Retirement – OAP/ORP Section

PO Box 9000

Tallahassee, Florida 32315-9000

Phone: 850-778-4696 Toll-free: 877-378-7677 FAX: 850-410-2030

Email:

A.

When to use Form ORP-REFUND.

This form is an application for the refund of only your voluntary employee contributions under the SUSORP.

Do not use this form for contract exchanges of contributions between SUSORP-approved providers and products.

You will need to contact your provider company for those forms.

Do not use this form to redirect future contributions to a different provider. If you are not retiring, and wish to

direct future contributions to a different provider, please submit form ORP-CHANGE.

If you are requesting a Required Minimum Distribution, please use form ORP-RMD.

Do not use this form to retire from the SUSORP and request a distribution (including a rollover distribution) of

employer and/or required employee contributions from your SUSORP account. Use form ORP-RETIRE.

Eligibility for Refund:

B.

Under Florida law, you are not eligible to access your SUSORP voluntary employee contributions and related

earnings until you terminate all employment relationships with all participating Florida Retirement System (FRS)

employers for three full calendar months.

NOTE: There may be tax penalties if you access the funds prior to age 59-1/2.

C.

Form Completion:

1. Complete Section I (Contact Information) and Section II (Member Certification) of the form. Your signature must

be notarized.

2. Have your SUSORP employer complete Section III (Employer Certification) of the form . Or you may also submit

the form with your notarized signature to the division and we will obtain the employer certification.

3. Submit the completed form to the Division of Retirement by fax, email, or U.S. Mail using the information provided

at the top of the form.

Upon receipt of the completed form, the division will verify your termination to determine your eligibility to receive a refund

of your voluntary employee contributions. The division will notify you if you are not eligible.

If your service provider gives you a form that requests a signature from the Division of Retirement, indicate on the

company form that Form ORP-REFUND will be sent to them by the division.

Please contact the Division of Retirement using the information at the top of this page or email

if you have any questions.

Rule 60U-1.012, F.A.C.

Instructional Page 1 of 1

1

1 2

2