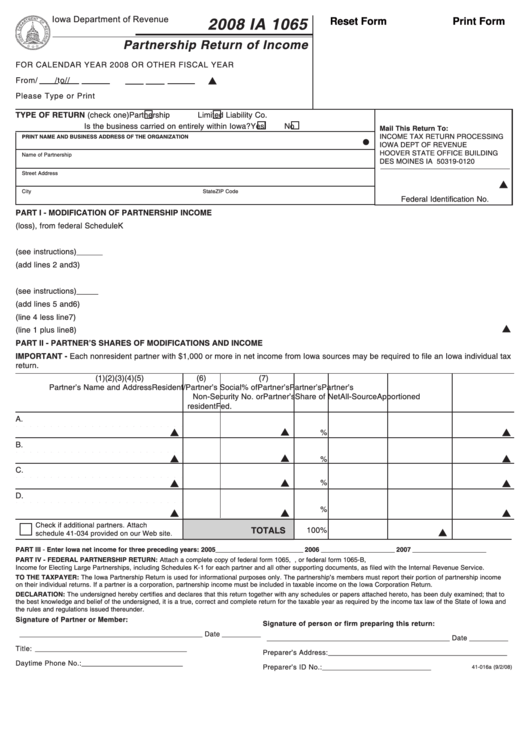

Iowa Department of Revenue

2008 IA 1065

Reset Form

Print Form

Partnership Return of Income

FOR CALENDAR YEAR 2008 OR OTHER FISCAL YEAR

From

/

/

to

/

/

Please Type or Print

TYPE OF RETURN (check one)

Partnership

Limited Liability Co.

Is the business carried on entirely within Iowa?

Yes

No

Mail This Return To:

INCOME TAX RETURN PROCESSING

PRINT NAME AND BUSINESS ADDRESS OF THE ORGANIZATION

IOWA DEPT OF REVENUE

HOOVER STATE OFFICE BUILDING

Name of Partnership

DES MOINES IA 50319-0120

Street Address

City

State

ZIP Code

Federal Identification No.

PART I - MODIFICATION OF PARTNERSHIP INCOME

1.Federal partnership taxable income (loss), from federal Schedule K ....................................................................... 1 ____________________

2.Interest from state and municipal bonds and securities .......................................... 2 ____________________

3.Other additions (see instructions) ............................................................................ 3 ____________________

4.Total additions (add lines 2 and 3) ............................................................................................................................ 4 ____________________

5.Interest and dividends from federal securities ......................................................... 5 ____________________

6.Other reductions (see instructions) .......................................................................... 6 ____________________

7.Total reductions (add lines 5 and 6) .......................................................................................................................... 7 ____________________

8.Net modifications (line 4 less line 7) .......................................................................................................................... 8 ____________________

9.Total all-source partnership income (line 1 plus line 8) ............................................................................................ 9 ____________________

PART II - PARTNER’S SHARES OF MODIFICATIONS AND INCOME

IMPORTANT - Each nonresident partner with $1,000 or more in net income from Iowa sources may be required to file an Iowa individual tax

return.

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Partner’s Name and Address

Resident/

Partner’s Social

% of

Partner’s

Partner’s

Partner’s

Non-

Security No. or

Partner’s

Share of Net

All-Source

Apportioned

resident

Fed. I.D. Number

Interest

Modifications

Income

Income

A.

%

B.

%

C.

%

D.

%

Check if additional partners. Attach

TOTALS

100%

schedule 41-034 provided on our Web site.

PART III - Enter Iowa net income for three preceding years: 2005 _________________________ 2006 _____________________ 2007 _____________________

PART IV - FEDERAL PARTNERSHIP RETURN: Attach a complete copy of federal form 1065, U.S. Partnership Return of Income, or federal form 1065-B, U.S. Return of

Income for Electing Large Partnerships, including Schedules K-1 for each partner and all other supporting documents, as filed with the Internal Revenue Service.

TO THE TAXPAYER: The Iowa Partnership Return is used for informational purposes only. The partnership’s members must report their portion of partnership income

on their individual returns. If a partner is a corporation, partnership income must be included in taxable income on the Iowa Corporation Return.

DECLARATION: The undersigned hereby certifies and declares that this return together with any schedules or papers attached hereto, has been duly examined; that to

the best knowledge and belief of the undersigned, it is a true, correct and complete return for the taxable year as required by the income tax law of the State of Iowa and

the rules and regulations issued thereunder.

Signature of Partner or Member:

Signature of person or firm preparing this return:

_______________________________________________ Date __________

_______________________________________________ Date __________

Title: _______________________________________

Preparer’s Address: ______________________________________________

Daytime Phone No.: __________________________

Preparer’s ID No.: ____________________________

41-016a (9/2/08)

1

1 2

2