Form Otp 01 - Other Tobacco Products (Otp) Excise Tax Return

ADVERTISEMENT

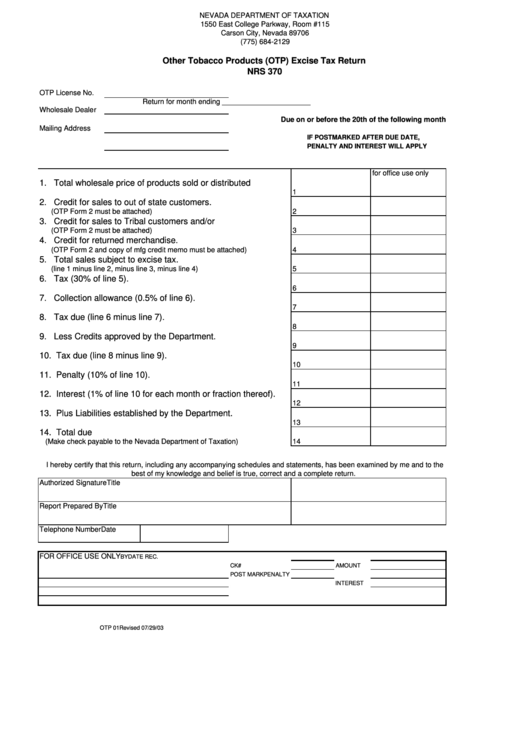

NEVADA DEPARTMENT OF TAXATION

1550 East College Parkway, Room #115

Carson City, Nevada 89706

(775) 684-2129

Other Tobacco Products (OTP) Excise Tax Return

NRS 370

OTP License No.

Return for month ending ______________________

Wholesale Dealer

Due on or before the 20th of the following month

Mailing Address

IF POSTMARKED AFTER DUE DATE,

PENALTY AND INTEREST WILL APPLY

for office use only

1. Total wholesale price of products sold or distributed

1

2. Credit for sales to out of state customers.

(OTP Form 2 must be attached)

2

3. Credit for sales to Tribal customers and/or U.S.Military.

(OTP Form 2 must be attached)

3

4. Credit for returned merchandise.

(OTP Form 2 and copy of mfg credit memo must be attached)

4

5. Total sales subject to excise tax.

(line 1 minus line 2, minus line 3, minus line 4)

5

6. Tax (30% of line 5).

6

7. Collection allowance (0.5% of line 6).

7

8. Tax due (line 6 minus line 7).

8

9. Less Credits approved by the Department.

9

10. Tax due (line 8 minus line 9).

10

11. Penalty (10% of line 10).

11

12. Interest (1% of line 10 for each month or fraction thereof).

12

13. Plus Liabilities established by the Department.

13

14. Total due

(Make check payable to the Nevada Department of Taxation)

14

I hereby certify that this return, including any accompanying schedules and statements, has been examined by me and to the

best of my knowledge and belief is true, correct and a complete return.

Authorized Signature

Title

Report Prepared By

Title

Date

Telephone Number

FOR OFFICE USE ONLY

BY

DATE REC.

CK#

AMOUNT

POST MARK

PENALTY

INTEREST

OTP 01

Revised 07/29/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4