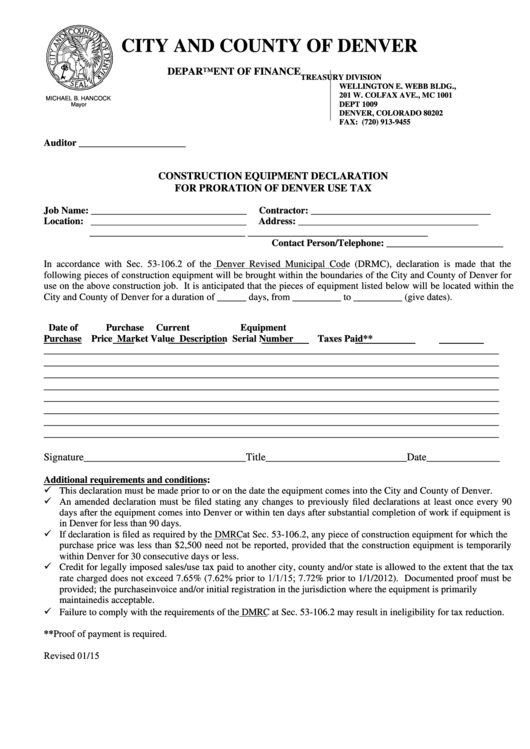

CITY AND COUNTY OF DENVER

DEPARTMENT OF FINANCE

TREASURY DIVISION

WELLINGTON E. WEBB BLDG.,

201 W. COLFAX AVE., MC 1001

MICHAEL B. HANCOCK

DEPT 1009

Mayor

DENVER, COLORADO 80202

FAX: (720) 913-9455

Auditor ______________________

CONSTRUCTION EQUIPMENT DECLARATION

FOR PRORATION OF DENVER USE TAX

Job Name: ________________________________

Contractor: _____________________________________

Location: ________________________________

Address:

_____________________________________

________________________________

_____________________________________

Contact Person/Telephone: ________________________

In accordance with Sec. 53-106.2 of the Denver Revised Municipal Code (DRMC), declaration is made that the

following pieces of construction equipment will be brought within the boundaries of the City and County of Denver for

use on the above construction job. It is anticipated that the pieces of equipment listed below will be located within the

City and County of Denver for a duration of ______ days, from __________ to __________ (give dates).

Date of

Purchase

Current

Equipment

Purchase

Price

Market Value

Description

Serial Number

Taxes Paid**

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

Signature_______________________________Title___________________________Date______________

Additional requirements and conditions:

This declaration must be made prior to or on the date the equipment comes into the City and County of Denver.

An amended declaration must be filed stating any changes to previously filed declarations at least once every 90

days after the equipment comes into Denver or within ten days after substantial completion of work if equipment is

in Denver for less than 90 days.

If declaration is filed as required by the DMRC at Sec. 53-106.2, any piece of construction equipment for which the

purchase price was less than $2,500 need not be reported, provided that the construction equipment is temporarily

within Denver for 30 consecutive days or less.

Credit for legally imposed sales/use tax paid to another city, county and/or state is allowed to the extent that the tax

rate charged does not exceed 7.65% (7.62% prior to 1/1/15; 7.72% prior to 1/1/2012). Documented proof must be

provided; the purchase invoice and/or initial registration in the jurisdiction where the equipment is primarily

maintained is acceptable.

Failure to comply with the requirements of the DMRC at Sec. 53-106.2 may result in ineligibility for tax reduction.

**Proof of payment is required.

Revised 01/15

1

1