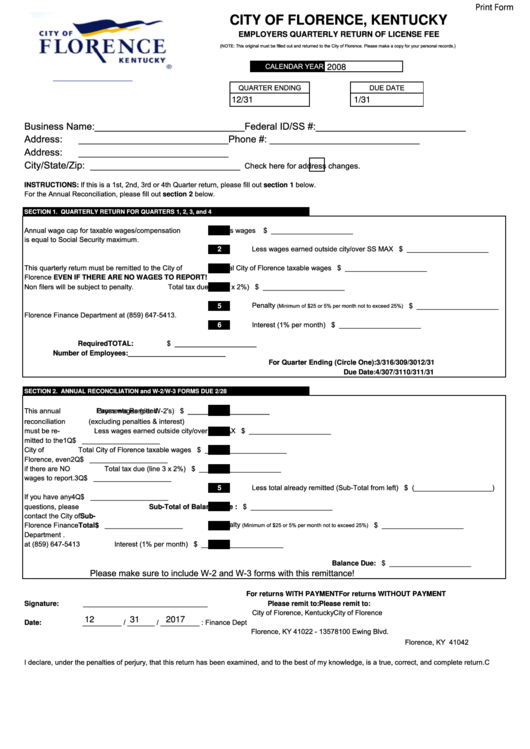

Print Form

CITY OF FLORENCE, KENTUCKY

EMPLOYERS QUARTERLY RETURN OF LICENSE FEE

(NOTE: This original must be filled out and returned to the City of Florence. Please make a copy for your personal records.)

CALENDAR YEAR

2008

QUARTER ENDING

DUE DATE

12/31

1/31

Business Name:

____________________________

Federal ID/SS #: ____________________________

Address:

____________________________

Phone #:

____________________________

Address:

____________________________

City/State/Zip:

____________________________

Check here for address changes.

INSTRUCTIONS: If this is a 1st, 2nd, 3rd or 4th Quarter return, please fill out section 1 below.

For the Annual Reconciliation, please fill out section 2 below.

SECTION 1. QUARTERLY RETURN FOR QUARTERS 1, 2, 3, and 4

Annual wage cap for taxable wages/compensation

Gross wages

$ _____________________

1

is equal to Social Security maximum.

Less wages earned outside city/over SS MAX

$ _____________________

2

This quarterly return must be remitted to the City of

Total City of Florence taxable wages

$ _____________________

3

Florence EVEN IF THERE ARE NO WAGES TO REPORT!

Non filers will be subject to penalty.

Total tax due (line 3 x 2%)

$ _____________________

4

Penalty

$ _____________________

(Minimum of $25 or 5% per month not to exceed 25%)

5

Florence Finance Department at (859) 647-5413.

Interest (1% per month)

$ _____________________

6

$ _____________________

Required

TOTAL:

Number of Employees: _________________________

For Quarter Ending (Circle One):

3/31

6/30

9/30

12/31

Due Date:

4/30

7/31

10/31

1/31

SECTION 2. ANNUAL RECONCILIATION and W-2/W-3 FORMS DUE 2/28

This annual

Payments Remitted

Gross wages (per W-2's)

$ _____________________

1

reconciliation

(excluding penalties & interest)

must be re-

Less wages earned outside city/over SS MAX

$ _____________________

2

mitted to the

1Q

$ ____________________

City of

Total City of Florence taxable wages

$ _____________________

3

Florence, even

2Q

$ ____________________

if there are NO

Total tax due (line 3 x 2%)

$ _____________________

4

wages to report.

3Q

$ ____________________

Less total already remitted (Sub-Total from left)

$ (____________________)

5

If you have any

4Q

$ ____________________

questions, please

$ _____________________

6

Sub-Total of Balance Due :

contact the City of Sub-

Penalty

Florence Finance Total $ ____________________

$ _____________________

(Minimum of $25 or 5% per month not to exceed 25%)

7

Department .

at (859) 647-5413

Interest (1% per month)

$ _____________________

8

$ _____________________

Balance Due:

Please make sure to include W-2 and W-3 forms with this remittance!

For returns WITH PAYMENT

For returns WITHOUT PAYMENT

________________________________

Signature:

Please remit to:

Please remit to:

City of Florence, Kentucky

City of Florence

12

31

2017

__________ / _______ / __________

P.O. Box 1357

Attn: Finance Dept

Date:

Florence, KY 41022 - 1357

8100 Ewing Blvd.

Florence, KY 41042

I declare, under the penalties of perjury, that this return has been examined, and to the best of my knowledge, is a true, correct, and complete return.C

1

1