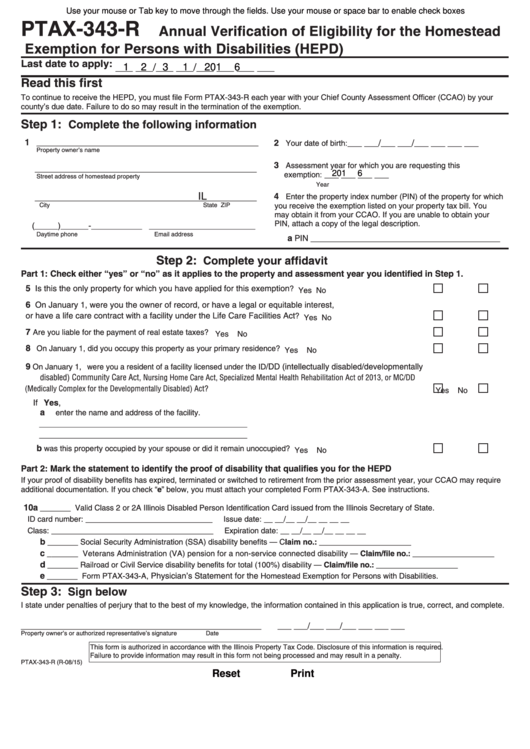

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

PTAX-343-R

Annual Verification of Eligibility for the Homestead

Exemption for Persons with Disabilities (HEPD)

Last date to apply: ___ ___/___ ___/___ ___ ___ ___

1

2

3

1

2

0

1

6

Read this first

To continue to receive the HEPD, you must file Form PTAX-343-R each year with your Chief County Assessment Officer (CCAO) by your

county’s due date. Failure to do so may result in the termination of the exemption.

Step 1:

Complete the following information

1 ________________________________________________

2

___ ___/___ ___/___ ___ ___ ___

Your date of birth:

Property owner’s name

3

Assessment year for which you are requesting this

________________________________________________

___ ___ ___ ___

exemption:

2

0

1

6

Street address of homestead property

Year

IL

4

Enter the property index number (PIN) of the property for which

________________________________________________

City

State

ZIP

you receive the exemption listed on your property tax bill. You

may obtain it from your CCAO. If you are unable to obtain your

PIN, attach a copy of the legal description.

(_____)______-___________ _______________________

Daytime phone

Email address

a PIN _________________________________________

Step 2:

Complete your affidavit

Part 1: Check either “yes” or “no” as it applies to the property and assessment year you identified in Step 1.

5 Is this the only property for which you have applied for this exemption

?

Yes

No

6 On January 1, were you the owner of record, or have a legal or equitable interest,

or have a life care contract with a facility under the Life Care Facilities Act

?

Yes

No

7

Are you liable for the payment of real estate taxes?

Yes

No

8

On January 1, did you occupy this property as your primary residence?

Yes

No

9

/DD (intellectually disabled/developmentally

On January 1, were you a resident of a facility licensed under the ID

disabled) Community Care Act,

Nursing Home Care Act, Specialized Mental Health Rehabilitation Act of 2013, or MC/DD

(Medically Complex for the Developmentally Disabled) Act?

Yes

No

If Yes,

a

enter the name and address of the facility.

_____________________________________________

_____________________________________________

b

was this property occupied by your spouse or did it remain unoccupied?

Yes

No

Part 2: Mark the statement to identify the proof of disability that qualifies you for the HEPD

If your proof of disability benefits has expired, terminated or switched to retirement from the prior assessment year, your CCAO may require

additional documentation. If you check “e” below, you must attach your completed Form PTAX-343-A. See instructions.

10 a

_______ Valid Class 2 or 2A Illinois Disabled Person Identification Card issued from the Illinois Secretary of State.

ID card number: _____________________________

Issue date: __ __/__ __/__ __ __ __

Class: _____________________________________

Expiration date: __ __/__ __/__ __ __ __

b

_______ Social Security Administration (SSA) disability benefits — Claim no.: _____________________

c

_______ Veterans Administration (VA) pension for a non-service connected disability — Claim/file no.: ___________________

d

_______ Railroad or Civil Service disability benefits for total (100%) disability — Claim/file no.: ___________________

e

Physician’s Statement for the

_______ Form PTAX-343-A,

Homestead Exemption for Persons with Disabilities.

Step 3:

Sign below

I state under penalties of perjury that to the best of my knowledge, the information contained in this application is true, correct, and complete.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Date

This form is authorized in accordance with the Illinois Property Tax Code. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

PTAX-343-R (R-08/15)

Reset

Print

1

1 2

2