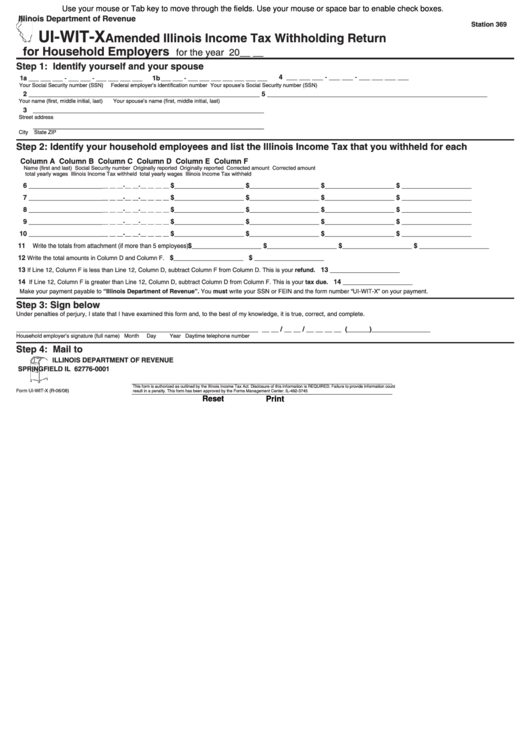

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Station 369

UI-WIT-X

Amended Illinois Income Tax Withholding Return

for Household Employers

for the year 20__ __

Step 1: Identify yourself and your spouse

1a ___ ___ ___ - ___ ___ - ___ ___ ___ ___ 1b ___ ___ - ___ ___ ___ ___ ___ ___ ___

4 ___ ___ ___ - ___ ___ - ___ ___ ___ ___

Your Social Security number (SSN)

Federal employer’s identification number

Your spouse’s Social Security number (SSN)

2 _______________________________________________________________

5 ____________________________________________________________

Your name (first, middle initial, last)

Your spouse’s name (first, middle initial, last)

3 _______________________________________________________________

Street address

_______________________________________________________________

City

State

ZIP

Step 2: Identify your household employees and list the Illinois Income Tax that you withheld for each

Column A

Column B

Column C

Column D

Column E

Column F

Name (first and last)

Social Security number

Originally reported

Originally reported

Corrected amount

Corrected amount

total yearly wages

Illinois Income Tax withheld

total yearly wages

Illinois Income Tax withheld

6 ____________________

$___________________

$___________________ $___________________ $ _ __________________

__ __ __-__ __-__ __ __ __

7 ____________________

$___________________

$___________________ $___________________ $ _ __________________

__ __ __-__ __-__ __ __ __

8 ____________________

$___________________

$___________________ $___________________ $ _ __________________

__ __ __-__ __-__ __ __ __

9 ____________________

$___________________

$___________________ $___________________ $ _ __________________

__ __ __-__ __-__ __ __ __

10 ____________________

$___________________

$___________________ $___________________ $ _ __________________

__ __ __-__ __-__ __ __ __

11

$ ___________________

$___________________ $___________________ $ _ __________________

W rite the totals from attachment (if more than 5 employees).

12

$___________________

$ _ __________________

Write the total amounts in Column D and Column F.

13

13 _ __________________

If Line 12, Column F is less than Line 12, Column D, subtract Column F from Column D. This is your refund.

14

14 _ __________________

If Line 12, Column F is greater than Line 12, Column D, subtract Column D from Column F. This is your tax due.

Make your payment payable to “Illinois Department of Revenue”. You must write your SSN or FEIN and the form number “UI-WIT-X” on your payment.

Step 3: Sign below

Under penalties of perjury, I state that I have examined this form and, to the best of my knowledge, it is true, correct, and complete.

__________________________________________________________________

__ __ / __ __ / __ __ __ __

(______)________________

Household employer’s signature (full name)

Month

Day

Year

Daytime telephone number

Step 4: Mail to

IllInoIS DEpARTMEnT oF REvEnUE

SpRIngFIElD Il 62776-0001

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could

Form UI-WIT-X (R-06/08)

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3745

Reset

Print

1

1 2

2