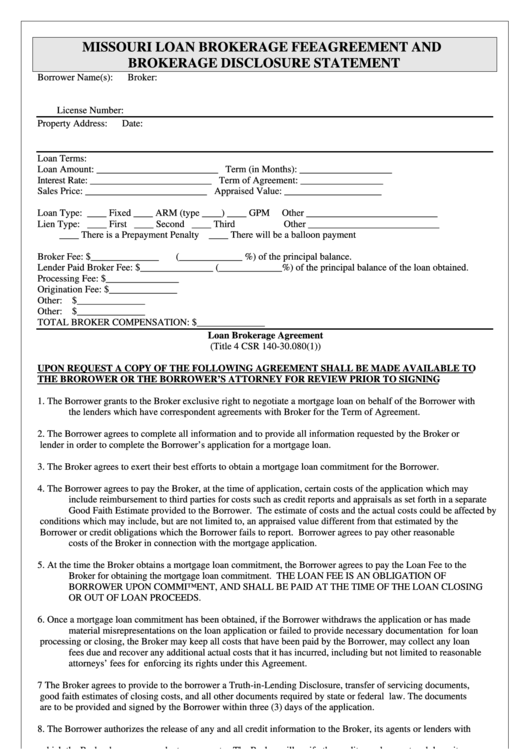

MISSOURI LOAN BROKERAGE FEE AGREEMENT AND

BROKERAGE DISCLOSURE STATEMENT

Borrower Name(s):

Broker:

License Number:

Property Address:

Date:

Loan Terms:

Loan Amount: _________________________

Term (in Months): ___________________

Interest Rate:

_________________________

Term of Agreement: _________________

Sales Price:

_________________________

Appraised Value: ____________________

Loan Type: ____ Fixed ____ ARM (type ____) ____ GPM

Other ___________________________

Lien Type: ____ First ____ Second ____ Third

Other ___________________________

____ There is a Prepayment Penalty

____ There will be a balloon payment

Broker Fee: $______________

(_____________ %) of the principal balance.

Lender Paid Broker Fee: $_______________ (_____________%) of the principal balance of the loan obtained.

Processing Fee: $_______________

Origination Fee: $______________

Other:

$______________

Other:

$______________

TOTAL BROKER COMPENSATION: $______________

Loan Brokerage Agreement

(Title 4 CSR 140-30.080(1))

UPON REQUEST A COPY OF THE FOLLOWING AGREEMENT SHALL BE MADE AVAILABLE TO

THE BROROWER OR THE BORROWER’S ATTORNEY FOR REVIEW PRIOR TO SIGNING

1.

The Borrower grants to the Broker exclusive right to negotiate a mortgage loan on behalf of the Borrower with

the lenders which have correspondent agreements with Broker for the Term of Agreement.

2.

The Borrower agrees to complete all information and to provide all information requested by the Broker or

lender in order to complete the Borrower’s application for a mortgage loan.

3.

The Broker agrees to exert their best efforts to obtain a mortgage loan commitment for the Borrower.

4.

The Borrower agrees to pay the Broker, at the time of application, certain costs of the application which may

include reimbursement to third parties for costs such as credit reports and appraisals as set forth in a separate

Good Faith Estimate provided to the Borrower. The estimate of costs and the actual costs could be affected by

conditions which may include, but are not limited to, an appraised value different from that estimated by the

Borrower or credit obligations which the Borrower fails to report. Borrower agrees to pay other reasonable

costs of the Broker in connection with the mortgage application.

5.

At the time the Broker obtains a mortgage loan commitment, the Borrower agrees to pay the Loan Fee to the

Broker for obtaining the mortgage loan commitment. THE LOAN FEE IS AN OBLIGATION OF

BORROWER UPON COMMITMENT, AND SHALL BE PAID AT THE TIME OF THE LOAN CLOSING

OR OUT OF LOAN PROCEEDS.

6.

Once a mortgage loan commitment has been obtained, if the Borrower withdraws the application or has made

material misrepresentations on the loan application or failed to provide necessary documentation for loan

processing or closing, the Broker may keep all costs that have been paid by the Borrower, may collect any loan

fees due and recover any additional actual costs that it has incurred, including but not limited to reasonable

attorneys’ fees for enforcing its rights under this Agreement.

7

The Broker agrees to provide to the borrower a Truth-in-Lending Disclosure, transfer of servicing documents,

good faith estimates of closing costs, and all other documents required by state or federal law. The documents

are to be provided and signed by the Borrower within three (3) days of the application.

8.

The Borrower authorizes the release of any and all credit information to the Broker, its agents or lenders with

which the Broker has correspondent agreements. The Broker will verify the credit, employment and deposit

accounts listed on the original loan application. If that information varies significantly, it may materially

affect the amount of the loan (due to details which could not be known by the Broker at the time of execution

of this Agreement) including but not limited to: appraised value of the Property, undisclosed credit obligation,

a change in financial circumstances, or a change in available loan programs which may result in the voiding of

this Agreement. Upon completion of all verifications and the Property appraisal, the Broker will submit the

application information to one or more lenders for their consideration to grant a loan commitment.

1

1 2

2