District Of Columbia Mortgage Disclosure Form

ADVERTISEMENT

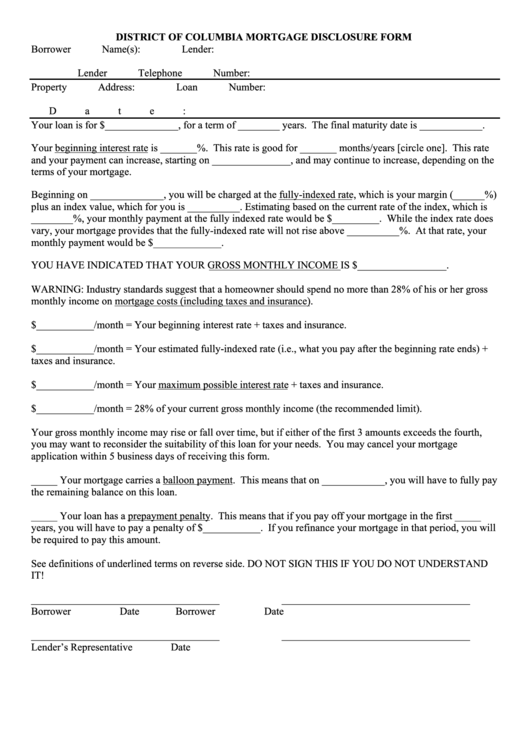

DISTRICT OF COLUMBIA MORTGAGE DISCLOSURE FORM

Borrower Name(s):

Lender:

Lender Telephone Number:

Property Address:

Loan Number:

Date:

Your loan is for $______________, for a term of ________ years. The final maturity date is ____________.

Your beginning interest rate is _______%. This rate is good for _______ months/years [circle one]. This rate

and your payment can increase, starting on _______________, and may continue to increase, depending on the

terms of your mortgage.

Beginning on ______________, you will be charged at the fully-indexed rate, which is your margin (______%)

plus an index value, which for you is __________. Estimating based on the current rate of the index, which is

________%, your monthly payment at the fully indexed rate would be $_________. While the index rate does

vary, your mortgage provides that the fully-indexed rate will not rise above __________%. At that rate, your

monthly payment would be $_____________.

YOU HAVE INDICATED THAT YOUR GROSS MONTHLY INCOME IS $_________________.

WARNING: Industry standards suggest that a homeowner should spend no more than 28% of his or her gross

monthly income on mortgage costs (including taxes and insurance).

$___________/month = Your beginning interest rate + taxes and insurance.

$___________/month = Your estimated fully-indexed rate (i.e., what you pay after the beginning rate ends) +

taxes and insurance.

$___________/month = Your maximum possible interest rate + taxes and insurance.

$___________/month = 28% of your current gross monthly income (the recommended limit).

Your gross monthly income may rise or fall over time, but if either of the first 3 amounts exceeds the fourth,

you may want to reconsider the suitability of this loan for your needs. You may cancel your mortgage

application within 5 business days of receiving this form.

_____ Your mortgage carries a balloon payment. This means that on ____________, you will have to fully pay

the remaining balance on this loan.

_____ Your loan has a prepayment penalty. This means that if you pay off your mortgage in the first _____

years, you will have to pay a penalty of $___________. If you refinance your mortgage in that period, you will

be required to pay this amount.

See definitions of underlined terms on reverse side. DO NOT SIGN THIS IF YOU DO NOT UNDERSTAND

IT!

____________________________________

____________________________________

Borrower

Date

Borrower

Date

____________________________________

____________________________________

Lender’s Representative

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2