Form Dc-2084-0313 - Form Group Tax Deferred Annuity Financial Hardship Request Instructions

ADVERTISEMENT

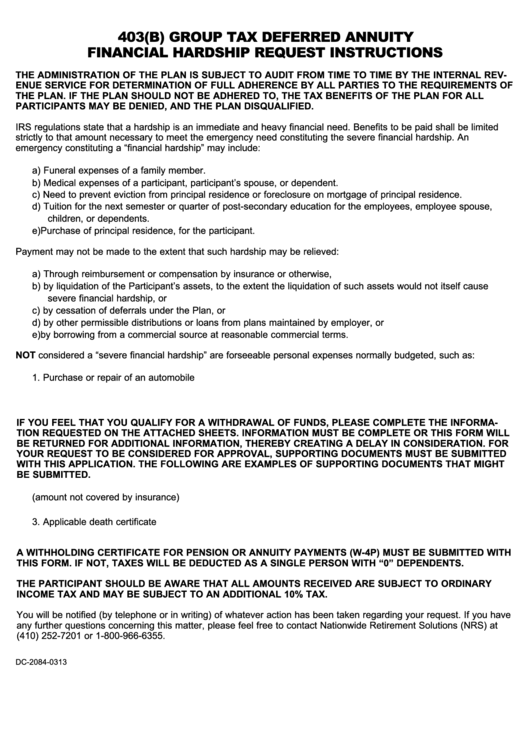

403(B) GROUP TAX DEFERRED ANNUITY

FINANCIAL HARDSHIP REQUEST INSTRUCTIONS

THE ADMINISTRATION OF THE PLAN IS SUBJECT TO AUDIT FROM TIME TO TIME BY THE INTERNAL REV-

ENUE SERVICE FOR DETERMINATION OF FULL ADHERENCE BY ALL PARTIES TO THE REQUIREMENTS OF

THE PLAN. IF THE PLAN SHOULD NOT BE ADHERED TO, THE TAX BENEFITS OF THE PLAN FOR ALL

PARTICIPANTS MAY BE DENIED, AND THE PLAN DISQUALIFIED.

IRS regulations state that a hardship is an immediate and heavy financial need. Benefits to be paid shall be limited

strictly to that amount necessary to meet the emergency need constituting the severe financial hardship. An

emergency constituting a “financial hardship” may include:

a) Funeral expenses of a family member.

b) Medical expenses of a participant, participant’s spouse, or dependent.

c) Need to prevent eviction from principal residence or foreclosure on mortgage of principal residence.

d) Tuition for the next semester or quarter of post-secondary education for the employees, employee spouse,

children, or dependents.

e) Purchase of principal residence, for the participant.

Payment may not be made to the extent that such hardship may be relieved:

a) Through reimbursement or compensation by insurance or otherwise,

b) by liquidation of the Participant’s assets, to the extent the liquidation of such assets would not itself cause

severe financial hardship, or

c) by cessation of deferrals under the Plan, or

d) by other permissible distributions or loans from plans maintained by employer, or

e) by borrowing from a commercial source at reasonable commercial terms.

NOT considered a “severe financial hardship” are forseeable personal expenses normally budgeted, such as:

1. Purchase or repair of an automobile

2. Normal monthly bills

3. Payment of loans

IF YOU FEEL THAT YOU QUALIFY FOR A WITHDRAWAL OF FUNDS, PLEASE COMPLETE THE INFORMA-

TION REQUESTED ON THE ATTACHED SHEETS. INFORMATION MUST BE COMPLETE OR THIS FORM WILL

BE RETURNED FOR ADDITIONAL INFORMATION, THEREBY CREATING A DELAY IN CONSIDERATION. FOR

YOUR REQUEST TO BE CONSIDERED FOR APPROVAL, SUPPORTING DOCUMENTS MUST BE SUBMITTED

WITH THIS APPLICATION. THE FOLLOWING ARE EXAMPLES OF SUPPORTING DOCUMENTS THAT MIGHT

BE SUBMITTED.

1. Medical bills (amount not covered by insurance)

2. Insurance statement showing amounts paid and amounts not paid

3. Applicable death certificate

4. Other documentation as may be needed

A WITHHOLDING CERTIFICATE FOR PENSION OR ANNUITY PAYMENTS (W-4P) MUST BE SUBMITTED WITH

THIS FORM. IF NOT, TAXES WILL BE DEDUCTED AS A SINGLE PERSON WITH “0” DEPENDENTS.

THE PARTICIPANT SHOULD BE AWARE THAT ALL AMOUNTS RECEIVED ARE SUBJECT TO ORDINARY

INCOME TAX AND MAY BE SUBJECT TO AN ADDITIONAL 10% TAX.

You will be notified (by telephone or in writing) of whatever action has been taken regarding your request. If you have

any further questions concerning this matter, please feel free to contact Nationwide Retirement Solutions (NRS) at

(410) 252-7201 or 1-800-966-6355.

DC-2084-0313

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4