Form Dvat 30 - Specimen Of Purchase / Inward Branch Transfer Register

ADVERTISEMENT

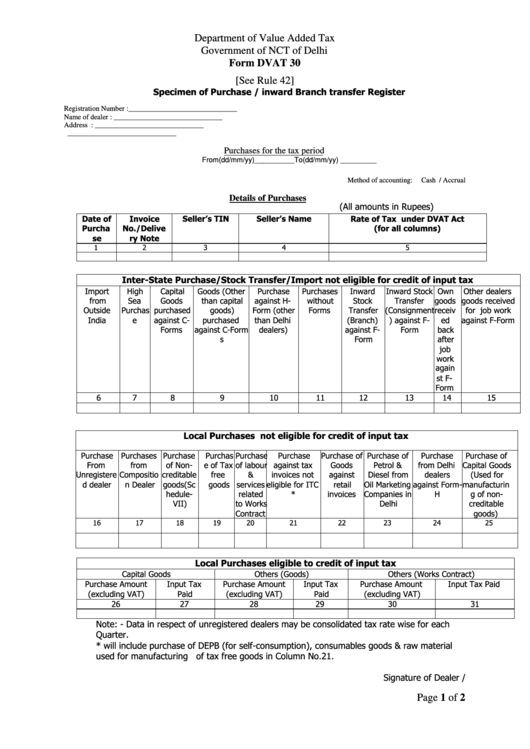

Department of Value Added Tax

Government of NCT of Delhi

Form DVAT 30

[See Rule 42]

Specimen of Purchase / inward Branch transfer Register

Registration Number :______________________________

Name of dealer

: ______________________________

Address

: ______________________________

______________________________

Purchases for the tax period

From(dd/mm/yy)__________To(dd/mm/yy) _________

Method of accounting:

Cash / Accrual

Details of Purchases

(All amounts in Rupees)

Date of

Invoice

Seller’s TIN

Seller’s Name

Rate of Tax under DVAT Act

Purcha

No./Delive

(for all columns)

se

ry Note

1

2

3

4

5

Inter-State Purchase/Stock Transfer/Import not eligible for credit of input tax

Import

High

Capital

Goods (Other

Purchase

Purchases

Inward

Inward Stock

Own

Other dealers

from

Sea

Goods

than capital

against H-

without

Stock

Transfer

goods

goods received

Outside

Purchas

purchased

goods)

Form (other

Forms

Transfer

(Consignment

receiv

for job work

India

e

against C-

purchased

than Delhi

(Branch)

) against F-

ed

against F-Form

Forms

against C-Form

dealers)

against F-

Form

back

s

Form

after

job

work

again

st F-

Form

6

7

8

9

10

11

12

13

14

15

Local Purchases not eligible for credit of input tax

Purchase

Purchases

Purchase

Purchas

Purchase

Purchase

Purchase of

Purchase of

Purchase

Purchase of

From

from

of Non-

e of Tax

of labour

against tax

Goods

Petrol &

from Delhi

Capital Goods

Unregistere

Compositio

creditable

free

&

invoices not

against

Diesel from

dealers

(Used for

d dealer

n Dealer

goods(Sc

goods

services

eligible for ITC

retail

Oil Marketing

against Form-

manufacturin

hedule-

related

*

invoices

Companies in

H

g of non-

VII)

to Works

Delhi

creditable

Contract

goods)

16

17

18

19

20

21

22

23

24

25

Local Purchases eligible to credit of input tax

Capital Goods

Others (Goods)

Others (Works Contract)

Purchase Amount

Input Tax

Purchase Amount

Input Tax

Purchase Amount

Input Tax Paid

(excluding VAT)

Paid

(excluding VAT)

Paid

(excluding VAT)

26

27

28

29

30

31

Note: - Data in respect of unregistered dealers may be consolidated tax rate wise for each

Quarter.

* will include purchase of DEPB (for self-consumption), consumables goods & raw material

used for manufacturing of tax free goods in Column No.21.

Signature of Dealer /

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2