Form Uc-347 - Notification Of Acquisitions Or Transfers - State Of Hawaii Department Of Labor And Industrial Relations

ADVERTISEMENT

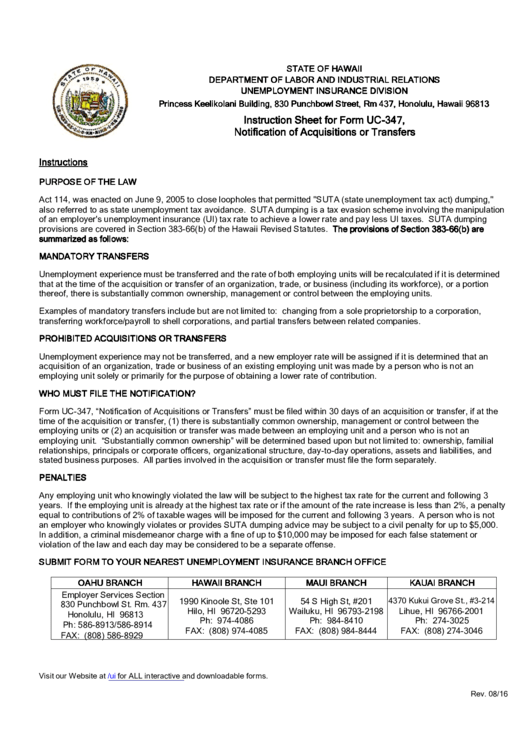

STATE OF HAWAII

DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS

UNEMPLOYMENT INSURANCE DIVISION

Princess Keelikolani Building, 830 Punchbowl Street, Rm 437, Honolulu, Hawaii 96813

Instruction Sheet for Form UC-347,

Notification of Acquisitions or Transfers

Instructions

PURPOSE OF THE LAW

Act 114, was enacted on June 9, 2005 to close loopholes that permitted "SUTA (state unemployment tax act) dumping,"

also referred to as state unemployment tax avoidance. SUTA dumping is a tax evasion scheme involving the manipulation

of an employer's unemployment insurance (UI) tax rate to achieve a lower rate and pay less UI taxes. SUTA dumping

provisions are covered in Section 383-66(b) of the Hawaii Revised Statutes. The provisions of Section 383-66(b) are

summarized as follows:

MANDATORY TRANSFERS

Unemployment experience must be transferred and the rate of both employing units will be recalculated if it is determined

that at the time of the acquisition or transfer of an organization, trade, or business (including its workforce), or a portion

thereof, there is substantially common ownership, management or control between the employing units.

Examples of mandatory transfers include but are not limited to: changing from a sole proprietorship to a corporation,

transferring workforce/payroll to shell corporations, and partial transfers between related companies.

PROHIBITED ACQUISITIONS OR TRANSFERS

Unemployment experience may not be transferred, and a new employer rate will be assigned if it is determined that an

acquisition of an organization, trade or business of an existing employing unit was made by a person who is not an

employing unit solely or primarily for the purpose of obtaining a lower rate of contribution.

WHO MUST FILE THE NOTIFICATION?

Form UC-347, “Notification of Acquisitions or Transfers” must be filed within 30 days of an acquisition or transfer, if at the

time of the acquisition or transfer, (1) there is substantially common ownership, management or control between the

employing units or (2) an acquisition or transfer was made between an employing unit and a person who is not an

employing unit. “Substantially common ownership” will be determined based upon but not limited to: ownership, familial

relationships, principals or corporate officers, organizational structure, day-to-day operations, assets and liabilities, and

stated business purposes. All parties involved in the acquisition or transfer must file the form separately.

PENALTIES

Any employing unit who knowingly violated the law will be subject to the highest tax rate for the current and following 3

years. If the employing unit is already at the highest tax rate or if the amount of the rate increase is less than 2%, a penalty

equal to contributions of 2% of taxable wages will be imposed for the current and following 3 years. A person who is not

an employer who knowingly violates or provides SUTA dumping advice may be subject to a civil penalty for up to $5,000.

In addition, a criminal misdemeanor charge with a fine of up to $10,000 may be imposed for each false statement or

violation of the law and each day may be considered to be a separate offense.

SUBMIT FORM TO YOUR NEAREST UNEMPLOYMENT INSURANCE BRANCH OFFICE

OAHU BRANCH

HAWAII BRANCH

MAUI BRANCH

KAUAI BRANCH

Employer Services Section

4370 Kukui Grove St., #3214

1990 Kinoole St, Ste 101

54 S High St, #201

830 Punchbowl St. Rm. 437

Hilo, HI 96720-5293

Wailuku, HI 96793-2198

Lihue, HI 96766-2001

Honolulu, HI 96813

Ph: 974-4086

Ph: 984-8410

Ph: 274-3025

Ph: 586-8913/586-8914

FAX: (808) 974-4085

FAX: (808) 984-8444

FAX: (808) 274-3046

FAX: (808) 586-8929

Visit our Website at

for ALL interactive and downloadable forms.

Rev. 08/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2