Local Services Tax - Exemption Certificate - 2015

ADVERTISEMENT

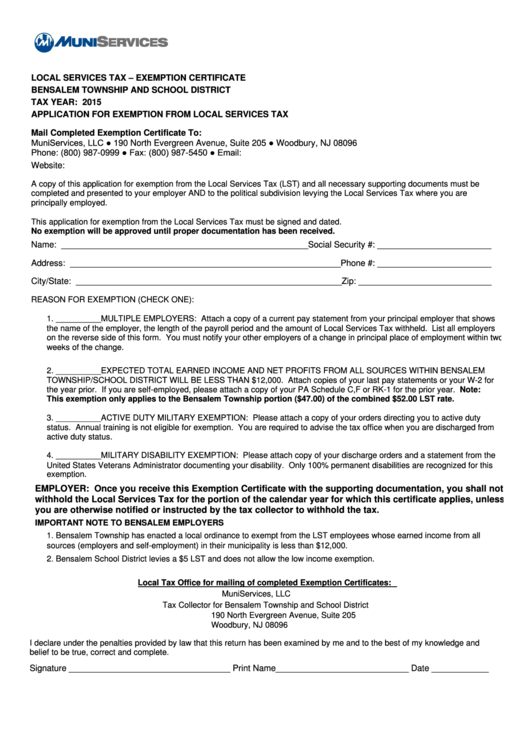

LOCAL SERVICES TAX – EXEMPTION CERTIFICATE

BENSALEM TOWNSHIP AND SCHOOL DISTRICT

TAX YEAR: 2015

APPLICATION FOR EXEMPTION FROM LOCAL SERVICES TAX

Mail Completed Exemption Certificate To:

MuniServices, LLC ● 190 North Evergreen Avenue, Suite 205 ● Woodbury, NJ 08096

Phone: (800) 987-0999 ● Fax: (800) 987-5450 ● Email:

Website:

A copy of this application for exemption from the Local Services Tax (LST) and all necessary supporting documents must be

completed and presented to your employer AND to the political subdivision levying the Local Services Tax where you are

principally employed.

This application for exemption from the Local Services Tax must be signed and dated.

No exemption will be approved until proper documentation has been received.

Name: ____________________________________________________Social Security #: ________________________

Address: _________________________________________________________Phone #: ________________________

City/State: ________________________________________________________Zip: ____________________________

REASON FOR EXEMPTION (CHECK ONE):

1. __________MULTIPLE EMPLOYERS: Attach a copy of a current pay statement from your principal employer that shows

the name of the employer, the length of the payroll period and the amount of Local Services Tax withheld. List all employers

on the reverse side of this form. You must notify your other employers of a change in principal place of employment within two

weeks of the change.

2. __________EXPECTED TOTAL EARNED INCOME AND NET PROFITS FROM ALL SOURCES WITHIN BENSALEM

TOWNSHIP/SCHOOL DISTRICT WILL BE LESS THAN $12,000. Attach copies of your last pay statements or your W-2 for

the year prior. If you are self-employed, please attach a copy of your PA Schedule C,F or RK-1 for the prior year. Note:

This exemption only applies to the Bensalem Township portion ($47.00) of the combined $52.00 LST rate.

3. __________ACTIVE DUTY MILITARY EXEMPTION: Please attach a copy of your orders directing you to active duty

status. Annual training is not eligible for exemption. You are required to advise the tax office when you are discharged from

active duty status.

4. __________MILITARY DISABILITY EXEMPTION: Please attach copy of your discharge orders and a statement from the

United States Veterans Administrator documenting your disability. Only 100% permanent disabilities are recognized for this

exemption.

EMPLOYER: Once you receive this Exemption Certificate with the supporting documentation, you shall not

withhold the Local Services Tax for the portion of the calendar year for which this certificate applies, unless

you are otherwise notified or instructed by the tax collector to withhold the tax.

IMPORTANT NOTE TO BENSALEM EMPLOYERS

1. Bensalem Township has enacted a local ordinance to exempt from the LST employees whose earned income from all

sources (employers and self-employment) in their municipality is less than $12,000.

2. Bensalem School District levies a $5 LST and does not allow the low income exemption.

Local Tax Office for mailing of completed Exemption Certificates:

MuniServices, LLC

Tax Collector for Bensalem Township and School District

190 North Evergreen Avenue, Suite 205

Woodbury, NJ 08096

I declare under the penalties provided by law that this return has been examined by me and to the best of my knowledge and

belief to be true, correct and complete.

Signature __________________________________ Print Name____________________________ Date ____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2