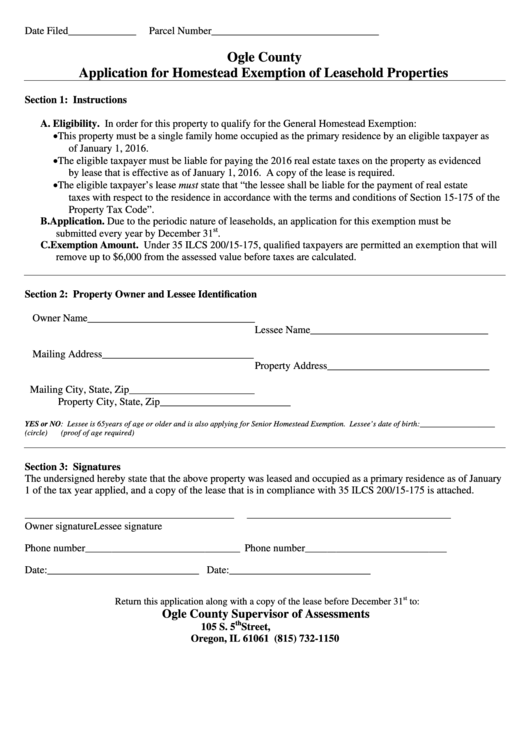

Date Filed_____________

Parcel Number________________________________

Ogle County

Application for Homestead Exemption of Leasehold Properties

Section 1: Instructions

A. Eligibility. In order for this property to qualify for the General Homestead Exemption:

• This property must be a single family home occupied as the primary residence by an eligible taxpayer as

of January 1, 2016.

• The eligible taxpayer must be liable for paying the 2016 real estate taxes on the property as evidenced

by lease that is effective as of January 1, 2016. A copy of the lease is required.

• The eligible taxpayer’s lease must state that “the lessee shall be liable for the payment of real estate

taxes with respect to the residence in accordance with the terms and conditions of Section 15-175 of the

Property Tax Code”.

B. Application. Due to the periodic nature of leaseholds, an application for this exemption must be

st

submitted every year by December 31

.

C. Exemption Amount. Under 35 ILCS 200/15-175, qualified taxpayers are permitted an exemption that will

remove up to $6,000 from the assessed value before taxes are calculated.

Section 2: Property Owner and Lessee Identification

Owner Name________________________________

Lessee Name__________________________________

Mailing Address_____________________________

Property Address_______________________________

Mailing City, State, Zip________________________

Property City, State, Zip_________________________

YES or NO: Lessee is 65 years of age or older and is also applying for Senior Homestead Exemption. Lessee’s date of birth:___________________

(circle)

(proof of age required)

Section 3: Signatures

The undersigned hereby state that the above property was leased and occupied as a primary residence as of January

1 of the tax year applied, and a copy of the lease that is in compliance with 35 ILCS 200/15-175 is attached.

________________________________________

_______________________________________

Owner signature

Lessee signature

Phone number

Phone number

___________________________________

________________________________

Date:_____________________________

Date:___________________________

st

Return this application along with a copy of the lease before December 31

to:

Ogle County Supervisor of Assessments

th

105 S. 5

Street, P.O. Box 40

Oregon, IL 61061 (815) 732-1150

1

1