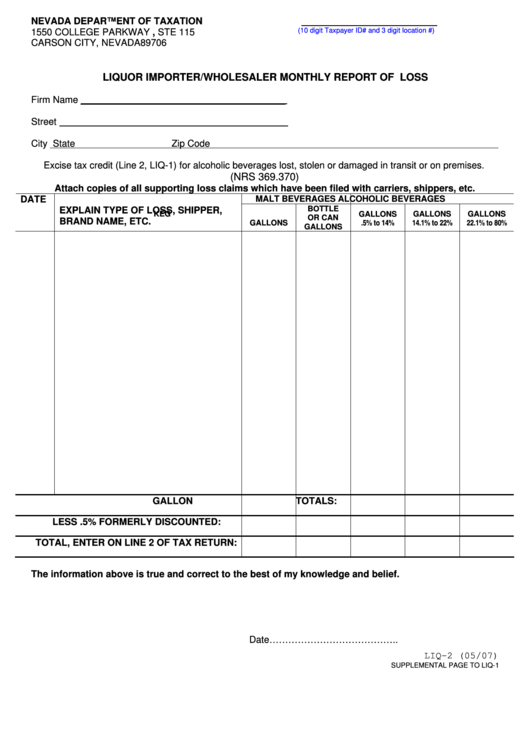

Form Liq-2 - Liquor Importer/wholesaler Monthly Report Of Loss - Nevada Department Of Taxation

ADVERTISEMENT

NEVADA DEPARTMENT OF TAXATION

TID

1550 COLLEGE PARKWAY , STE 115

(10 digit Taxpayer ID# and 3 digit location #)

CARSON CITY, NEVADA 89706

For the Month of ______________________

LIQUOR IMPORTER/WHOLESALER MONTHLY REPORT OF LOSS

Firm Name _______________________________________

Street

City

State

Zip Code

Excise tax credit (Line 2, LIQ-1) for alcoholic beverages lost, stolen or damaged in transit or on premises.

(NRS 369.370)

Attach copies of all supporting loss claims which have been filed with carriers, shippers, etc.

MALT BEVERAGES

ALCOHOLIC BEVERAGES

BOTTLE

DATE

EXPLAIN TYPE OF LOSS, SHIPPER,

KEG

GALLONS

GALLONS

GALLONS

OR CAN

BRAND NAME, ETC.

.5% to 14%

14.1% to 22%

22.1% to 80%

GALLONS

GALLONS

GALLON TOTALS:

LESS .5% FORMERLY DISCOUNTED:

TOTAL, ENTER ON LINE 2 OF TAX RETURN:

The information above is true and correct to the best of my knowledge and belief.

Signed ..................................................................................

Title.......................................................................................

Date…………………………………..

LIQ-2 (05/07)

SUPPLEMENTAL PAGE TO LIQ-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1