Report Of Tax On Meals & Lodging Form

ADVERTISEMENT

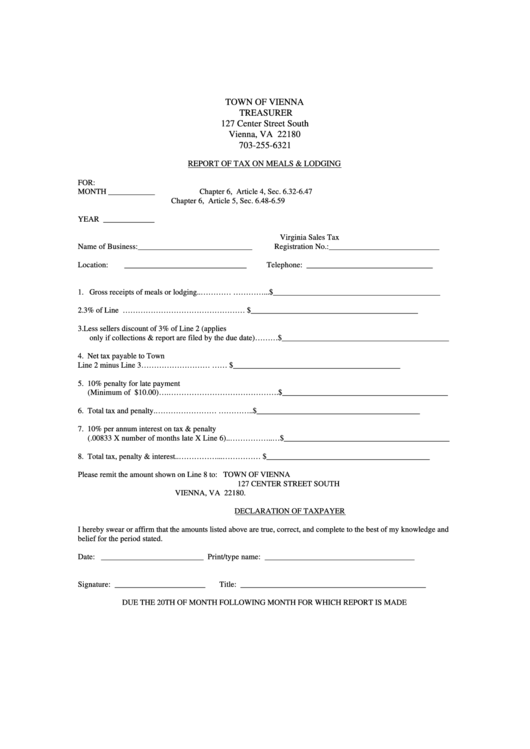

TOWN OF VIENNA

TREASURER

127 Center Street South

Vienna, VA 22180

703-255-6321

REPORT OF TAX ON MEALS & LODGING

FOR:

MONTH ____________

Chapter 6, Article 4, Sec. 6.32-6.47

Chapter 6, Article 5, Sec. 6.48-6.59

YEAR _____________

Virginia Sales Tax

Name of Business:_____________________________

Registration No.:____________________________

Location:

_______________________________

Telephone: ________________________________

1. Gross receipts of meals or lodging..…………....…………...$___________________________________________

2. 3% of Line 1.....…………………………………………......$___________________________________________

3. Less sellers discount of 3% of Line 2 (applies

only if collections & report are filed by the due date)………$___________________________________________

4. Net tax payable to Town

Line 2 minus Line 3………………………..........……...........$___________________________________________

5. 10% penalty for late payment

(Minimum of $10.00)….…………………………………….$__________________________________________

6. Total tax and penalty.…………………….............…………..$__________________________________________

7. 10% per annum interest on tax & penalty

(.00833 X number of months late X Line 6)..……………..…$__________________________________________

8. Total tax, penalty & interest..……………...……………........$__________________________________________

Please remit the amount shown on Line 8 to:

TOWN OF VIENNA

127 CENTER STREET SOUTH

VIENNA, VA 22180.

DECLARATION OF TAXPAYER

I hereby swear or affirm that the amounts listed above are true, correct, and complete to the best of my knowledge and

belief for the period stated.

Date: __________________________

Print/type name: ______________________________________

Signature: _______________________

Title: _______________________________________________

DUE THE 20TH OF MONTH FOLLOWING MONTH FOR WHICH REPORT IS MADE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1