Form Dvat 42 - Application For Determination Of Specific Question Under Delhi Value Added Tax Act

ADVERTISEMENT

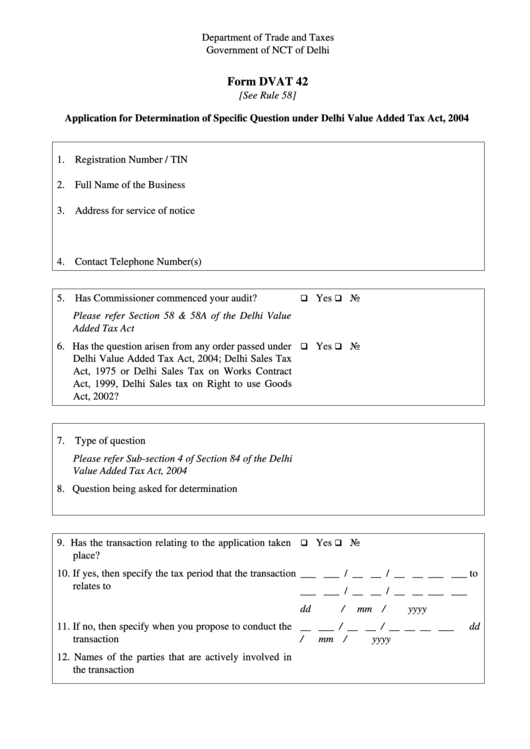

Department of Trade and Taxes

Government of NCT of Delhi

Form DVAT 42

[See Rule 58]

Application for Determination of Specific Question under Delhi Value Added Tax Act, 2004

1. Registration Number / TIN

2. Full Name of the Business

3. Address for service of notice

4. Contact Telephone Number(s)

5. Has Commissioner commenced your audit?

Yes

No

Please refer Section 58 & 58A of the Delhi Value

Added Tax Act

6. Has the question arisen from any order passed under

Yes

No

Delhi Value Added Tax Act, 2004; Delhi Sales Tax

Act, 1975 or Delhi Sales Tax on Works Contract

Act, 1999, Delhi Sales tax on Right to use Goods

Act, 2002?

7. Type of question

Please refer Sub-section 4 of Section 84 of the Delhi

Value Added Tax Act, 2004

8. Question being asked for determination

9. Has the transaction relating to the application taken

Yes

No

place?

10. If yes, then specify the tax period that the transaction

___ ___ / __ __ / __ __ ___ ___ to

relates to

___ ___ / __ __ / __ __ ___ ___

dd

/

mm /

yyyy

11. If no, then specify when you propose to conduct the

__ ___ / __ __ / __ __ __ ___

dd

transaction

/

mm /

yyyy

12. Names of the parties that are actively involved in

the transaction

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4