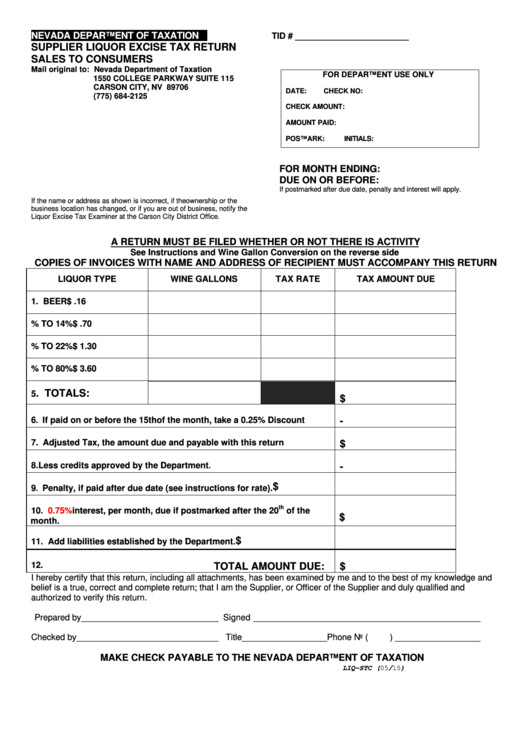

NEVADA DEPARTMENT OF TAXATION

TID # ________________________

SUPPLIER LIQUOR EXCISE TAX RETURN

SALES TO CONSUMERS

Mail original to: Nevada Department of Taxation

FOR DEPARTMENT USE ONLY

1550 COLLEGE PARKWAY SUITE 115

CARSON CITY, NV 89706

DATE:

CHECK NO:

(775) 684-2125

CHECK AMOUNT:

AMOUNT PAID:

POSTMARK:

INITIALS:

FOR MONTH ENDING:

DUE ON OR BEFORE:

If postmarked after due date, penalty and interest will apply.

If the name or address as shown is incorrect, if the ownership or the

business location has changed, or if you are out of business, notify the

Liquor Excise Tax Examiner at the Carson City District Office.

A RETURN MUST BE FILED WHETHER OR NOT THERE IS ACTIVITY

See Instructions and Wine Gallon Conversion on the reverse side

COPIES OF INVOICES WITH NAME AND ADDRESS OF RECIPIENT MUST ACCOMPANY THIS RETURN

LIQUOR TYPE

WINE GALLONS

TAX RATE

TAX AMOUNT DUE

1. BEER

$ .16

2. WINE .5% TO 14%

$ .70

3. WINE 14.1% TO 22%

$ 1.30

4. LIQUOR 22.1% TO 80%

$ 3.60

. TOTALS:

5

$

6

If paid on or before the 15th of the month, take a 0.25% Discount

.

-

7. Adjusted Tax, the amount due and payable with this return

$

8. Less credits approved by the Department

.

-

$

9

Penalty, if paid after due date (see instructions for rate).

.

th

10.

0.75%

interest, per month, due if postmarked after the 20

of the

$

month.

$

11. Add liabilities established by the Department.

12.

TOTAL AMOUNT DUE:

$

I hereby certify that this return, including all attachments, has been examined by me and to the best of my knowledge and

belief is a true, correct and complete return; that I am the Supplier, or Officer of the Supplier and duly qualified and

authorized to verify this return.

Prepared by _____________________________

Signed ________________________________________________

Checked by ______________________________

Title__________________ Phone No (

) __________________

MAKE CHECK PAYABLE TO THE NEVADA DEPARTMENT OF TAXATION

LIQ-STC (05/15)

1

1 2

2