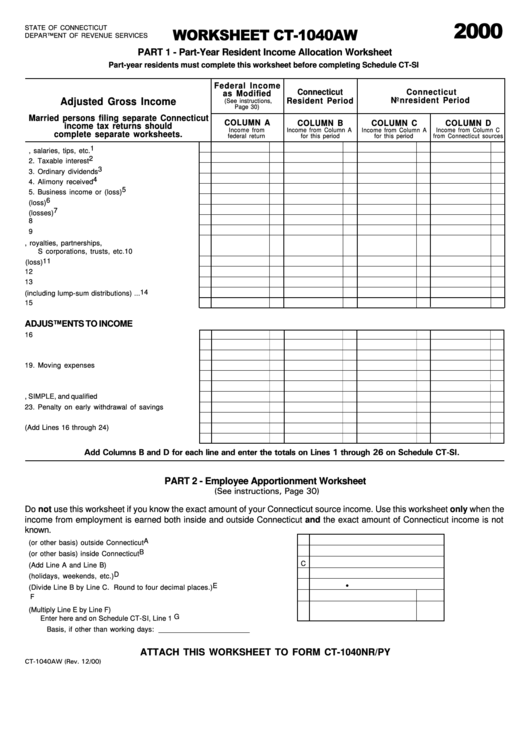

Worksheet Ct-1040aw - 2000

ADVERTISEMENT

2000

STATE OF CONNECTICUT

WORKSHEET CT-1040AW

DEPARTMENT OF REVENUE SERVICES

PART 1 - Part-Year Resident Income Allocation Worksheet

Part-year residents must complete this worksheet before completing Schedule CT-SI

Federal Income

Connecticut

Connecticut

as Modified

Nonresident Period

Adjusted Gross Income

Resident Period

(See instructions,

Page 30)

Married persons filing separate Connecticut

COLUMN A

COLUMN B

COLUMN C

COLUMN D

income tax returns should

Income from Column A

Income from

Income from Column A

Income from Column C

complete separate worksheets.

federal return

for this period

for this period

from Connecticut sources

1

1. Wages, salaries, tips, etc. .......................................

2

2. Taxable interest ........................................................

3

3. Ordinary dividends ...................................................

4

4. Alimony received .....................................................

5

5. Business income or (loss) ......................................

6

6. Capital gain or (loss) ................................................

7

7. Other gains or (losses) ...........................................

8

8. Taxable amount of IRA distributions .......................

9

9. Taxable amount of pensions and annuities ............

10. Rental real estate, royalties, partnerships,

S corporations, trusts, etc. ..................................... 10

11. Farm income or (loss) .............................................. 11

12. Unemployment compensation ................................. 12

13. Taxable amount of social security benefits ........... 13

14. Other income (including lump-sum distributions) ... 14

15. Add Lines 1 through 14 ........................................... 15

ADJUSTMENTS TO INCOME

16. IRA deduction ........................................................... 16

17. Student loan interest deduction .............................. 17

18. Medical savings account deduction ....................... 18

19. Moving expenses ..................................................... 19

20. One-half of self-employment tax ............................ 20

21. Self-employed health insurance deduction ............ 21

22. Self-employed SEP, SIMPLE, and qualified plans ... 22

23. Penalty on early withdrawal of savings ................ 23

24. Alimony paid ............................................................. 24

25. Total adjustments (Add Lines 16 through 24) ........ 25

26. Subtract Line 25 from Line 15 ................................. 26

Add Columns B and D for each line and enter the totals on Lines 1 through 26 on Schedule CT-SI.

PART 2 - Employee Apportionment Worksheet

(See instructions, Page 30)

Do not use this worksheet if you know the exact amount of your Connecticut source income. Use this worksheet only when the

income from employment is earned both inside and outside Connecticut and the exact amount of Connecticut income is not

known.

A. Working days (or other basis) outside Connecticut ................................................ A

B. Working days (or other basis) inside Connecticut .................................................. B

C. Total working days (Add Line A and Line B) ........................................................... C

D. Nonworking days (holidays, weekends, etc.) ........................................................ D

.

E

E. Connecticut ratio (Divide Line B by Line C. Round to four decimal places.) ......

F

F. Total income being apportioned ................................................................................

G. Connecticut income (Multiply Line E by Line F)

Enter here and on Schedule CT-SI, Line 1 ............................................................... G

Basis, if other than working days: _______________________

ATTACH THIS WORKSHEET TO FORM CT-1040NR/PY

CT-1040AW (Rev. 12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1