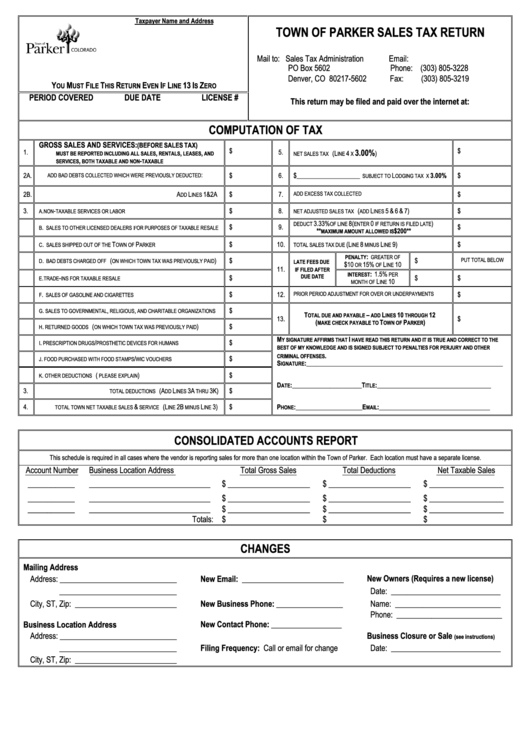

Town Of Parker Sales Tax Return Form

ADVERTISEMENT

Taxpayer Name and Address

TOWN OF PARKER SALES TAX RETURN

Mail to: Sales Tax Administration

Email:

PO Box 5602

Phone: (303) 805-3228

Denver, CO 80217-5602

Fax:

(303) 805-3219

Y

M

F

T

R

E

I

L

13 I

Z

OU

UST

ILE

HIS

ETURN

VEN

F

INE

S

ERO

PERIOD COVERED

DUE DATE

LICENSE #

This return may be filed and paid over the internet at:

COMPUTATION OF TAX

GROSS SALES AND SERVICES:

(BEFORE SALES TAX)

3.00%

1.

$

5.

$

,

,

,

(L

4

)

MUST BE REPORTED INCLUDING ALL SALES

RENTALS

LEASES

AND

NET SALES TAX

INE

X

,

-

SERVICES

BOTH TAXABLE AND NON

TAXABLE

2A.

:

$

6.

$____________________

L

3.00%

$

ADD BAD DEBTS COLLECTED WHICH WERE PREVIOUSLY DEDUCTED

SUBJECT TO

ODGING TAX X

2B.

A

L

1 & 2A

$

7.

$

DD

INES

ADD EXCESS TAX COLLECTED

3.

.

-

$

8.

(

L

5 & 6 & 7)

$

A

NON

TAXABLE SERVICES OR LABOR

NET ADJUSTED SALES TAX

ADD

INES

3.33%

8 (

0

)

DEDUCT

OF LINE

ENTER

IF RETURN IS FILED LATE

.

$

9.

$

B

SALES TO OTHER LICENSED DEALERS FOR PURPOSES OF TAXABLE RESALE

**

$200**

MAXIMUM AMOUNT ALLOWED IS

.

T

P

$

10.

(L

8

L

9)

$

C

SALES SHIPPED OUT OF THE

OWN OF

ARKER

TOTAL SALES TAX DUE

INE

MINUS

INE

:

PENALTY

GREATER OF

.

(

)

$

$

D

BAD DEBTS CHARGED OFF

ON WHICH TOWN TAX WAS PREVIOUSLY PAID

PUT TOTAL BELOW

LATE FEES DUE

$10

15%

L

10

OR

OF

INE

11.

IF FILED AFTER

: 1.5%

INTEREST

PER

.

-

$

$

$

DUE DATE

E

TRADE

INS FOR TAXABLE RESALE

L

10

MONTH OF

INE

.

$

12.

$

F

SALES OF GASOLINE AND CIGARETTES

PRIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENTS

.

,

,

$

G

SALES TO GOVERNMENTAL

RELIGIOUS

AND CHARITABLE ORGANIZATIONS

T

–

L

10

12

OTAL DUE AND PAYABLE

ADD

INES

THROUGH

13.

$

(

T

P

)

MAKE CHECK PAYABLE TO

OWN OF

ARKER

.

(

)

$

H

RETURNED GOODS

ON WHICH TOWN TAX WAS PREVIOUSLY PAID

M

I

Y SIGNATURE AFFIRMS THAT

HAVE READ THIS RETURN AND IT IS TRUE AND CORRECT TO THE

.

/

$

I

PRESCRIPTION DRUGS

PROSTHETIC DEVICES FOR HUMANS

BEST OF MY KNOWLEDGE AND IS SIGNED SUBJECT TO PENALTIES FOR PERJURY AND OTHER

.

CRIMINAL OFFENSES

.

/

$

J

FOOD PURCHASED WITH FOOD STAMPS

WIC VOUCHERS

S

: ______________________________________________________________

IGNATURE

.

(

)

$

K

OTHER DEDUCTIONS

PLEASE EXPLAIN

D

: ______________________

T

: ____________________________________

ATE

ITLE

3.

(A

L

3A

3K)

$

TOTAL DEDUCTIONS

DD

INES

THRU

4.

&

(L

2B

L

3)

$

P

: _____________________

E

: ___________________________________

HONE

MAIL

TOTAL TOWN NET TAXABLE SALES

SERVICE

INE

MINUS

INE

CONSOLIDATED ACCOUNTS REPORT

This schedule is required in all cases where the vendor is reporting sales for more than one location within the Town of Parker. Each location must have a separate license.

Account Number

Business Location Address

Total Gross Sales

Total Deductions

Net Taxable Sales

____________

_______________________________

$ _____________________

$ _____________________

$ ___________________

____________

_______________________________

$ _____________________

$ _____________________

$ ___________________

____________

_______________________________

$ _____________________

$ _____________________

$ ___________________

Totals:

$

$

$

CHANGES

Mailing Address

Address: ______________________________

New Email: __________________________

New Owners (Requires a new license)

______________________________

Date: ____________________________

City, ST, Zip: __________________________

New Business Phone: _________________

Name: ___________________________

Phone: ___________________________

Business Location Address

New Contact Phone: __________________

Address: ______________________________

Business Closure or Sale

(see instructions)

______________________________

Filing Frequency: Call or email for change

Date: ____________________________

City, ST, Zip: __________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1