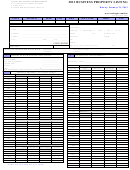

Personal Property Listing Form - Wake County Revenue Department - 2008 Page 2

ADVERTISEMENT

PROPERTY TAX LISTING INSTRUCTIONS

A

PHYSICAL LOCATION

Enter physical location of listed property as of January 1, 2008. If listing property residing at multiple locations, please complete a separate listing form for

each location.

B

OWNERSHIP

Please provide all requested information.

C

OWNER INFORMATION

Please provide all requested information.

D

REAL ESTATE

Owners as of January 1, 2008 are required to report any buildings, additions, improvements, and/or deletions that occurred during the prior calendar year

where a building permit was not issued. These changes must be reported whether made by you or someone else. If you purchased a house and lot,

townhome or condominium in 2007, please enter your total cost and percent of completion as of January 1, 2008.

E

PERSONAL PROPERTY

List all boats, boat motors, mobile homes, aircraft, and unlicensed vehicles owned by you on January 1, 2008. Please provide complete descriptions of all

property.

Licensed Vehicles - Do not list vehicles currently licensed by the NC Department of Motor Vehicles. The tax on these vehicles will be billed

approximately 90 days after the license is renewed or application is made for a new registration.

Unlicensed Vehicles - Vehicles not licensed with the NC Department of Motor Vehicles must be listed. Vehicles include automobiles, trucks, trailers of

all types, motorcycles, and motor homes. If your vehicle is damaged or claimed as a total loss, submit any information as to its condition as of January 1,

2008.

Boats - Boat ownership is determined by information received from the NC Wildlife Commission. Boats registered with the NC Wildlife Commission

should receive a separate preprinted listing form. If you do not receive a preprinted listing, list your boat on this form.

Farmers, Carpenters, and Mechanics - Persons owning tools and equipment used in a trade or business should list on a Business listing form. Business

listing forms are available on our web site. Please visit

Rented Furnishings - Landlords owning a furnished rental unit (house, apartment, condo, mobile home, etc.) should list on a Business listing form.

Business listing forms are available on our web site. Please visit

F

AFFIRMATION

Signature must be that of owner, partner, principal officer or individual having power of attorney

PROPERTY TAX RELIEF FOR ELDERLY AND PERMANENTLY DISABLED

North Carolina General Statute 105-277.1

North Carolina excludes from property taxes the first $25,000 or 50% (whichever is greater) of assessed value for real property, or a manufactured home,

occupied by the owner as their permanent residence. To qualify for the exclusion, applicants must meet both of the following requirements:

1. Must be 65 years old or older, or totally and permanently disabled. If not 65 years old but totally and permanently disabled, you will need a certificate

from a physician licensed to practice medicine in North Carolina. It is essential that the certificate state your disability is total and permanent.

2. Total annual income for both applicant and spouse must not exceed $25,000. Income is defined as all moneys received other than gifts or inheritances

from a spouse, ancestor, or descendant. For married applicants residing with their spouse, the income of both spouses must be included even if only one is

an owner of the property.

If you are currently receiving the exclusion, you do not need to reapply unless your permanent residence has changed. Current recipients are required to

notify our office if your income now exceeds $25,000 or you are no longer totally and permanently disabled.

If the person receiving the exclusion last year was deceased prior to January 1, 2008:

·

The person required by law to list the property must notify the Wake County Revenue Department.

·

The surviving spouse or joint property owner is required to reapply for the exclusion if qualified.

Failure to make any of these notices before June 1, 2008 will result in penalties, interest, and the possible loss of the exclusion.

The deadline to submit a completed application form is June 1, 2008. You may obtain an application form from the Wake County Revenue

Department by calling (919) 856-5400.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2