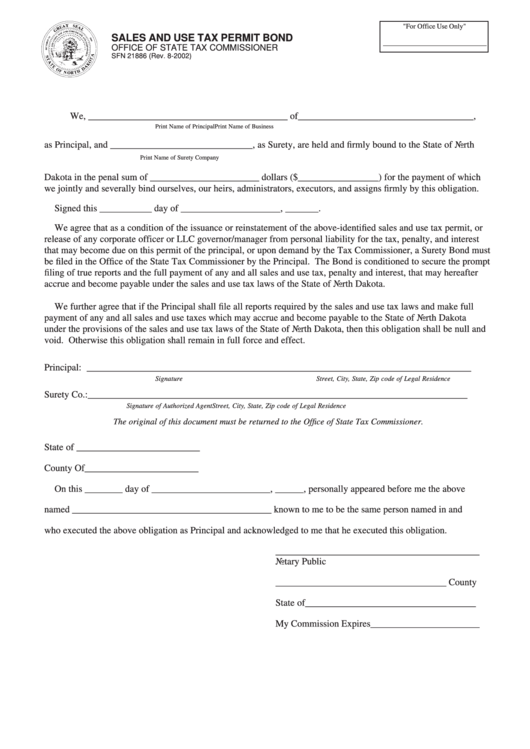

"For Office Use Only"

SALES AND USE TAX PERMIT BOND

_____________________________

OFFICE OF STATE TAX COMMISSIONER

SFN 21886 (Rev. 8-2002)

We, __________________________________________ of _____________________________________,

Print Name of Principal

Print Name of Business

as Principal, and ______________________________, as Surety, are held and firmly bound to the State of North

Print Name of Surety Company

Dakota in the penal sum of _______________________ dollars ($_________________) for the payment of which

we jointly and severally bind ourselves, our heirs, administrators, executors, and assigns firmly by this obligation.

Signed this ___________ day of _____________________, _______.

We agree that as a condition of the issuance or reinstatement of the above-identified sales and use tax permit, or

release of any corporate officer or LLC governor/manager from personal liability for the tax, penalty, and interest

that may become due on this permit of the principal, or upon demand by the Tax Commissioner, a Surety Bond must

be filed in the Office of the State Tax Commissioner by the Principal. The Bond is conditioned to secure the prompt

filing of true reports and the full payment of any and all sales and use tax, penalty and interest, that may hereafter

accrue and become payable under the sales and use tax laws of the State of North Dakota.

We further agree that if the Principal shall file all reports required by the sales and use tax laws and make full

payment of any and all sales and use taxes which may accrue and become payable to the State of North Dakota

under the provisions of the sales and use tax laws of the State of North Dakota, then this obligation shall be null and

void. Otherwise this obligation shall remain in full force and effect.

Principal: ______________________________________ ___________________________________________

Signature

Street, City, State, Zip code of Legal Residence

Surety Co.: _____________________________________ ___________________________________________

Signature of Authorized Agent

Street, City, State, Zip code of Legal Residence

The original of this document must be returned to the Office of State Tax Commissioner.

State of __________________________

County Of ________________________

On this ________ day of _________________________, ______, personally appeared before me the above

named __________________________________________ known to me to be the same person named in and

who executed the above obligation as Principal and acknowledged to me that he executed this obligation.

___________________________________________

Notary Public

____________________________________ County

State of ____________________________________

My Commission Expires_______________________

1

1