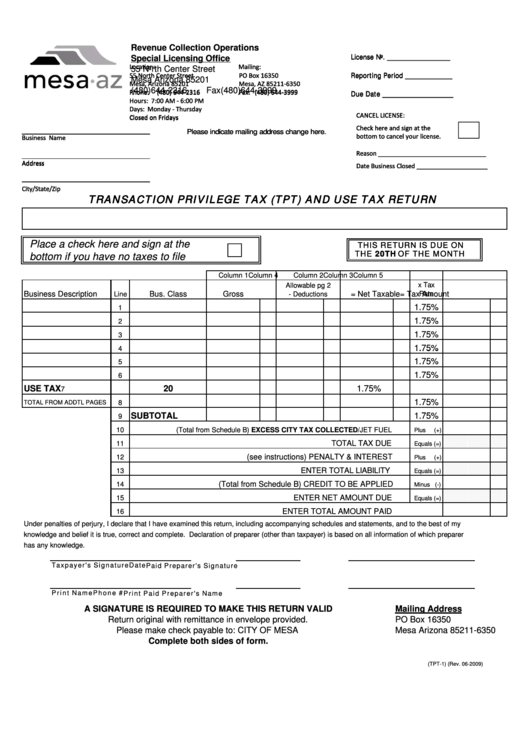

Revenue Collection Operations

License No. ________________

License No. ________________

Special Licensing Office

Location:

Location:

Mailing:

Mailing:

55 North Center Street

Reporting Period ____________

Reporting Period ____________

55 North Center Street

55 North Center Street

PO Box 16350

PO Box 16350

Mesa Arizona 85201

Mesa, Arizona 85201

Mesa, Arizona 85201

Mesa, AZ 85211‐6350

Mesa, AZ 85211‐6350

(480)644-2316

Fax(480)644-3999

Phone: (480) 644‐2316

Phone: (480) 644‐2316

Fax: (480) 644‐3999

Fax: (480) 644‐3999

Due Date __________________

Due Date __________________

Hours: 7:00 AM ‐ 6:00 PM

Hours: 7:00 AM ‐ 6:00 PM

Days: Monday ‐ Thursday

Days: Monday ‐ Thursday

CANCEL LICENSE:

CANCEL LICENSE:

Closed on Fridays

Closed on Fridays

Check here and sign at the

Check here and sign at the

Please indicate mailing address change here.

Please indicate mailing address change here.

bottom to cancel your license.

bottom to cancel your license.

Business Name

Business Name

Reason ________________________________

Reason ________________________________

Address

Address

Date Business Closed _____________________

Date Business Closed _____________________

City/State/Zip

City/State/Zip

TRANSACTION PRIVILEGE TAX (TPT) AND USE TAX RETURN

Place a check here and sign at the

THIS RETURN IS DUE ON

THIS RETURN IS DUE ON

THE 20TH OF THE MONTH

THE 20TH OF THE MONTH

bottom if you have no taxes to file

Column 1

Column 2

Column 3

Column 4

Column 5

x Tax

Allowable pg 2

Business Description

Bus. Class

Gross

= Net Taxable

= Tax Amount

Rate

Line

- Deductions

1.75%

1

1.75%

2

1.75%

3

1.75%

1.75%

4

4

1.75%

5

1.75%

6

USE TAX

20

1.75%

7

1.75%

TOTAL FROM ADDTL PAGES

8

SUBTOTAL

1.75%

9

10

(Total from Schedule B) EXCESS CITY TAX COLLECTED/JET FUEL

Plus

(+)

TOTAL TAX DUE

11

Equals (=)

(see instructions) PENALTY & INTEREST

12

Plus

(+)

ENTER TOTAL LIABILITY

13

Equals (=)

(Total from Schedule B) CREDIT TO BE APPLIED

14

Minus (-)

ENTER NET AMOUNT DUE

15

Equals (=)

ENTER TOTAL AMOUNT PAID

16

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer

has any knowledge.

T axpa ye r's S ig na tu re

D ate

P a id P rep a rer's S ign atu re

P rin t N a m e

P ho ne #

P rin t P aid P re pa re r's N am e

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID

Mailing Address

Return original with remittance in envelope provided.

PO Box 16350

Please make check payable to: CITY OF MESA

Mesa Arizona 85211-6350

Complete both sides of form.

(TPT-1) (Rev. 06-2009)

1

1 2

2