Student Social Security Exemption Form

ADVERTISEMENT

CLEAR FORM

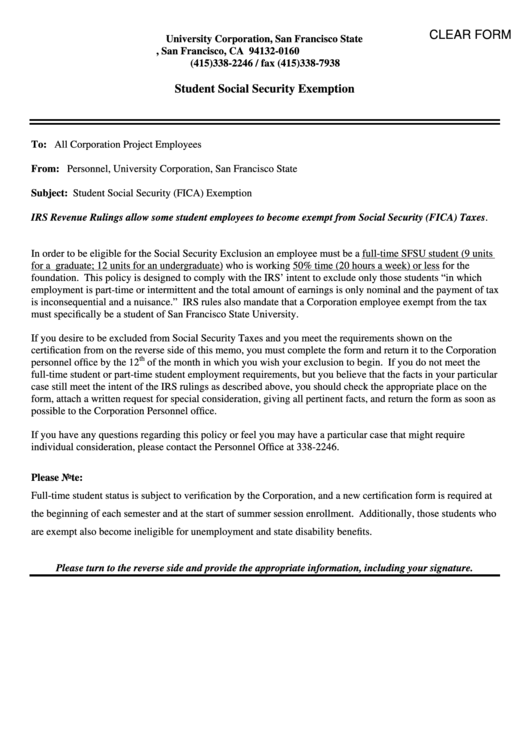

University Corporation, San Francisco State

P.O. Box 320160, San Francisco, CA 94132-0160

(415)338-2246 / fax (415)338-7938

Student Social Security Exemption

To:

All Corporation Project Employees

From:

Personnel, University Corporation, San Francisco State

Subject:

Student Social Security (FICA) Exemption

IRS Revenue Rulings allow some student employees to become exempt from Social Security (FICA) Taxes.

In order to be eligible for the Social Security Exclusion an employee must be a full-time SFSU student (9 units

for a graduate; 12 units for an undergraduate) who is working 50% time (20 hours a week) or less for the

foundation. This policy is designed to comply with the IRS’ intent to exclude only those students “in which

employment is part-time or intermittent and the total amount of earnings is only nominal and the payment of tax

is inconsequential and a nuisance.” IRS rules also mandate that a Corporation employee exempt from the tax

must specifically be a student of San Francisco State University.

If you desire to be excluded from Social Security Taxes and you meet the requirements shown on the

certification from on the reverse side of this memo, you must complete the form and return it to the Corporation

th

personnel office by the 12

of the month in which you wish your exclusion to begin. If you do not meet the

full-time student or part-time student employment requirements, but you believe that the facts in your particular

case still meet the intent of the IRS rulings as described above, you should check the appropriate place on the

form, attach a written request for special consideration, giving all pertinent facts, and return the form as soon as

possible to the Corporation Personnel office.

If you have any questions regarding this policy or feel you may have a particular case that might require

individual consideration, please contact the Personnel Office at 338-2246.

Please Note:

Full-time student status is subject to verification by the Corporation, and a new certification form is required at

the beginning of each semester and at the start of summer session enrollment. Additionally, those students who

are exempt also become ineligible for unemployment and state disability benefits.

Please turn to the reverse side and provide the appropriate information, including your signature.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2