Property Value Appeal Form - Moore County Tax Office - 2016

ADVERTISEMENT

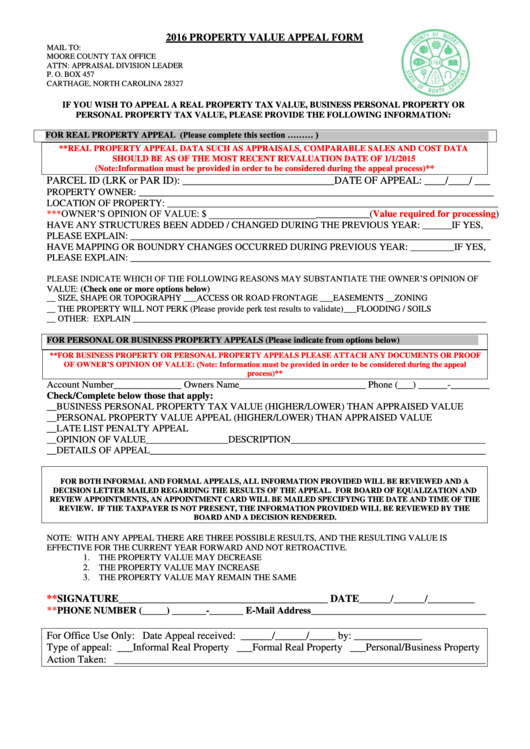

2018 PROPERTY VALUE APPEAL FORM

MAIL TO:

MOORE COUNTY TAX OFFICE

ATTN: APPRAISAL DIVISION LEADER

P. O. BOX 457

CARTHAGE, NORTH CAROLINA 28327

IF YOU WISH TO APPEAL A REAL PROPERTY TAX VALUE, BUSINESS PERSONAL PROPERTY OR

PERSONAL PROPERTY TAX VALUE, PLEASE PROVIDE THE FOLLOWING INFORMATION:

(Please complete this section ………..See reverse side for additional information)

FOR REAL PROPERTY APPEAL

**REAL PROPERTY APPEAL DATA SUCH AS APPRAISALS, COMPARABLE SALES AND COST DATA

SHOULD BE AS OF THE MOST RECENT REVALUATION DATE OF 1/1/2015

(Note: Information must be provided in order to be considered during the appeal process)**

PARCEL ID (LRK or PAR ID): _____________________________DATE OF APPEAL: ____/____/ ___

PROPERTY OWNER: _________________________________________________________________________

LOCATION OF PROPERTY: ____________________________________________________________________

***OWNER’S OPINION OF VALUE: $

_________________________________(Value required for

processing)

HAVE ANY STRUCTURES BEEN ADDED / CHANGED DURING THE PREVIOUS YEAR: ______IF YES,

PLEASE EXPLAIN: __________________________________________________________________________

HAVE MAPPING OR BOUNDRY CHANGES OCCURRED DURING PREVIOUS YEAR: _________IF YES,

PLEASE EXPLAIN: __________________________________________________________________________

PLEASE INDICATE WHICH OF THE FOLLOWING REASONS MAY SUBSTANTIATE THE OWNER’S OPINION OF

VALUE: (Check one or more options below)

__ SIZE, SHAPE OR TOPOGRAPHY

___ACCESS OR ROAD FRONTAGE

___EASEMENTS __ZONING

__ THE PROPERTY WILL NOT PERK (Please provide perk test results to validate)

___FLOODING / SOILS

__ OTHER: EXPLAIN ________________________________________________________________________________

FOR PERSONAL OR BUSINESS PROPERTY APPEALS

(Please indicate from options below)

**FOR BUSINESS PROPERTY OR PERSONAL PROPERTY APPEALS PLEASE ATTACH ANY DOCUMENTS OR PROOF

OF OWNER’S OPINION OF VALUE: (Note: Information must be provided in order to be considered during the appeal

process)**

Account Number______________ Owners Name__________________________ Phone (___) ______-________

Check/Complete below those that apply:

__BUSINESS PERSONAL PROPERTY TAX VALUE (HIGHER/LOWER) THAN APPRAISED VALUE

__PERSONAL PROPERTY VALUE APPEAL (HIGHER/LOWER) THAN APPRAISED VALUE

__LATE LIST PENALTY APPEAL

__OPINION OF VALUE_________________DESCRIPTION________________________________________

__DETAILS OF APPEAL_____________________________________________________________________

FOR BOTH INFORMAL AND FORMAL APPEALS, ALL INFORMATION PROVIDED WILL BE REVIEWED AND A

DECISION LETTER MAILED REGARDING THE RESULTS OF THE APPEAL. FOR BOARD OF EQUALIZATION AND

REVIEW APPOINTMENTS, AN APPOINTMENT CARD WILL BE MAILED SPECIFYING THE DATE AND TIME OF THE

REVIEW. IF THE TAXPAYER IS NOT PRESENT, THE INFORMATION PROVIDED WILL BE REVIEWED BY THE

BOARD AND A DECISION RENDERED.

NOTE: WITH ANY APPEAL THERE ARE THREE POSSIBLE RESULTS, AND THE RESULTING VALUE IS

EFFECTIVE FOR THE CURRENT YEAR FORWARD AND NOT RETROACTIVE.

1.

THE PROPERTY VALUE MAY DECREASE

2.

THE PROPERTY VALUE MAY INCREASE

3.

THE PROPERTY VALUE MAY REMAIN THE SAME

**SIGNATURE________________________________________ DATE______/______/_________

**

PHONE NUMBER (_____) _______-_______ E-Mail Address____________________________________

For Office Use Only:

Date Appeal received: ______/______/_____ by: _____________

Type of appeal: ___Informal Real Property ___Formal Real Property ___Personal/Business Property

Action Taken: _______________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2