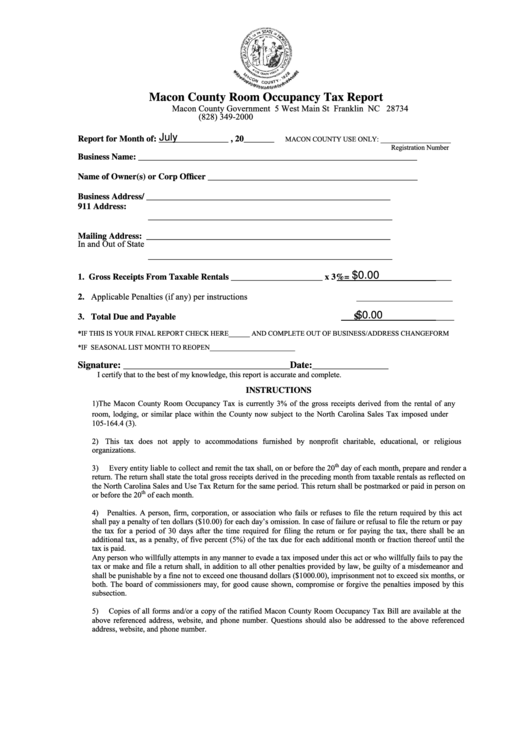

Macon County Room Occupancy Tax Report

Macon County Government 5 West Main St Franklin NC 28734

(828) 349-2000

July

__________________

MACON COUNTY USE ONLY:

Report for Month of: ________________ , 20_______

Registration Number

Business Name: ________________________________________________________________

Name of Owner(s) or Corp Officer ________________________________________________

Business Address/ ________________________________________________________

911 Address:

________________________________________________________

Mailing Address: ________________________________________________________

In and Out of State

________________________________________________________

$0.00

1. Gross Receipts From Taxable Rentals _____________________ x 3%= _______________________

2. Applicable Penalties (if any) per instructions

______________________

$0.00

3. Total Due and Payable

$______________________

*IF THIS IS YOUR FINAL REPORT CHECK HERE______ AND COMPLETE OUT OF BUSINESS/ADDRESS CHANGE FORM

*IF SEASONAL LIST MONTH TO REOPEN________________________

Signature: ___________________________________Date:________________

I certify that to the best of my knowledge, this report is accurate and complete.

INSTRUCTIONS

1)

The Macon County Room Occupancy Tax is currently 3% of the gross receipts derived from the rental of any

room, lodging, or similar place within the County now subject to the North Carolina Sales Tax imposed under G.S.

105-164.4 (3).

2)

This tax does not apply to accommodations furnished by nonprofit charitable, educational, or religious

organizations.

th

3)

Every entity liable to collect and remit the tax shall, on or before the 20

day of each month, prepare and render a

return. The return shall state the total gross receipts derived in the preceding month from taxable rentals as reflected on

the North Carolina Sales and Use Tax Return for the same period. This return shall be postmarked or paid in person on

th

or before the 20

of each month.

4)

Penalties. A person, firm, corporation, or association who fails or refuses to file the return required by this act

shall pay a penalty of ten dollars ($10.00) for each day’s omission. In case of failure or refusal to file the return or pay

the tax for a period of 30 days after the time required for filing the return or for paying the tax, there shall be an

additional tax, as a penalty, of five percent (5%) of the tax due for each additional month or fraction thereof until the

tax is paid.

Any person who willfully attempts in any manner to evade a tax imposed under this act or who willfully fails to pay the

tax or make and file a return shall, in addition to all other penalties provided by law, be guilty of a misdemeanor and

shall be punishable by a fine not to exceed one thousand dollars ($1000.00), imprisonment not to exceed six months, or

both. The board of commissioners may, for good cause shown, compromise or forgive the penalties imposed by this

subsection.

5)

Copies of all forms and/or a copy of the ratified Macon County Room Occupancy Tax Bill are available at the

above referenced address, website, and phone number. Questions should also be addressed to the above referenced

address, website, and phone number.

1

1