Form Av-10 - Application For Property Tax Exemption

ADVERTISEMENT

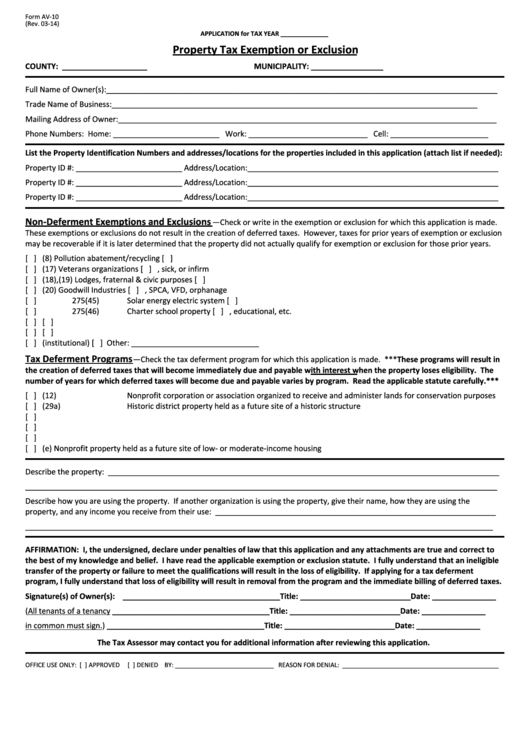

Form AV-10

(Rev. 03-14)

APPLICATION for TAX YEAR ______________

Property Tax Exemption or Exclusion

COUNTY: ____________________

MUNICIPALITY: _________________

Full Name of Owner(s):____________________________________________________________________________________________

Trade Name of Business:______________________________________________________________________________________

Mailing Address of Owner:_________________________________________________________________________________________

Phone Numbers: Home: _________________________ Work: ____________________________ Cell: _______________________

List the Property Identification Numbers and addresses/locations for the properties included in this application (attach list if needed):

Property ID #: _________________________ Address/Location:___________________________________________________________

Property ID #: _________________________ Address/Location:___________________________________________________________

Property ID #: _________________________ Address/Location:___________________________________________________________

Non-Deferment Exemptions and Exclusions

—Check or write in the exemption or exclusion for which this application is made.

These exemptions or exclusions do not result in the creation of deferred taxes. However, taxes for prior years of exemption or exclusion

may be recoverable if it is later determined that the property did not actually qualify for exemption or exclusion for those prior years.

[ ] G.S. 105-275(8)

Pollution abatement/recycling

[ ] G.S. 105-278.5

Religious educational assemblies

[ ] G.S. 105-275(17)

Veterans organizations

[ ] G.S. 105-278.6

Home for the aged, sick, or infirm

[ ] G.S. 105-275(18),(19)

Lodges, fraternal & civic purposes

[ ] G.S. 105-278.6

Low- or moderate-income housing

[ ] G.S. 105-275(20)

Goodwill Industries

[ ] G.S. 105-278.6

YMCA, SPCA, VFD, orphanage

[ ] G.S. 105-275(45)

Solar energy electric system

[ ] G.S. 105-278.6A

CCRC-Attach Form AV-11

[ ] G.S. 105-275(46)

Charter school property

[ ] G.S. 105-278.7

Other charitable, educational, etc.

[ ] G.S. 105-277.13

Brownfields-Attach brownfields agreement

[ ] G.S. 105-278.8

Charitable hospital purposes

[ ] G.S. 105-278.3

Religious purposes

[ ] G.S. 131A-21

Medical Care Commission bonds

[ ] G.S. 105-278.4

Educational purposes (institutional)

[ ] Other:

______________________________

Tax Deferment Programs

—Check the tax deferment program for which this application is made. ***These programs will result in

the creation of deferred taxes that will become immediately due and payable with interest when the property loses eligibility. The

number of years for which deferred taxes will become due and payable varies by program. Read the applicable statute carefully.***

[ ] G.S. 105-275(12)

Nonprofit corporation or association organized to receive and administer lands for conservation purposes

[ ] G.S. 105-275(29a)

Historic district property held as a future site of a historic structure

[ ] G.S. 105-277.14

Working waterfront property

[ ] G.S. 105-277.15A

Site infrastructure land

[ ] G.S. 105-278

Historic property-Attach copy of the local ordinance designating property as historic property or landmark.

[ ] G.S. 105-278.6(e)

Nonprofit property held as a future site of low- or moderate-income housing

Describe the property: ____________________________________________________________________________________________

_______________________________________________________________________________________________________________

Describe how you are using the property. If another organization is using the property, give their name, how they are using the

property, and any income you receive from their use: __________________________________________________________________

______________________________________________________________________________________________________________

AFFIRMATION: I, the undersigned, declare under penalties of law that this application and any attachments are true and correct to

the best of my knowledge and belief. I have read the applicable exemption or exclusion statute. I fully understand that an ineligible

transfer of the property or failure to meet the qualifications will result in the loss of eligibility. If applying for a tax deferment

program, I fully understand that loss of eligibility will result in removal from the program and the immediate billing of deferred taxes.

Signature(s) of Owner(s):

_____________________________________Title: __________________________Date: _______________

(All tenants of a tenancy

_____________________________________Title: __________________________Date: _______________

in common must sign.)

_____________________________________Title: __________________________Date: _______________

The Tax Assessor may contact you for additional information after reviewing this application.

OFFICE USE ONLY: [ ] APPROVED

[ ] DENIED BY: _____________________________ REASON FOR DENIAL: ______________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1