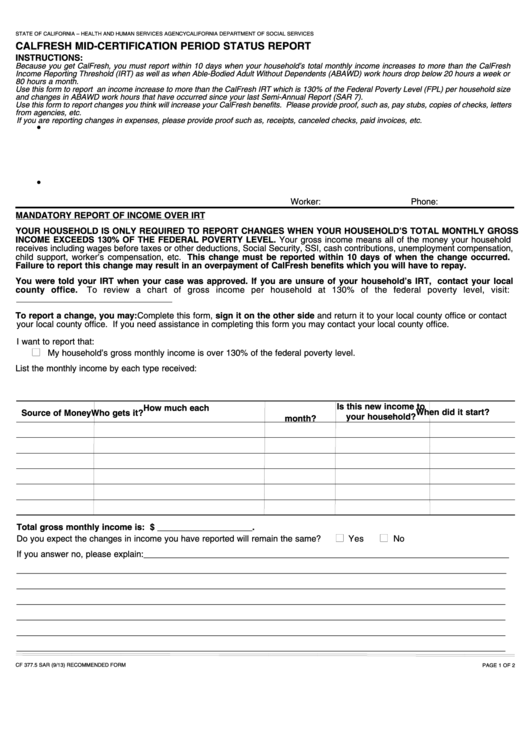

STATE OF CALIFORNIA – HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CALFRESH MID-CERTIFICATION PERIOD STATUS REPORT

INSTRUCTIONS:

Because you get CalFresh, you must report within 10 days when your household’s total monthly income increases to more than the CalFresh

Income Reporting Threshold (IRT) as well as when Able-Bodied Adult Without Dependents (ABAWD) work hours drop below 20 hours a week or

80 hours a month.

Use this form to report an income increase to more than the CalFresh IRT which is 130% of the Federal Poverty Level (FPL) per household size

and changes in ABAWD work hours that have occurred since your last Semi-Annual Report (SAR 7).

Use this form to report changes you think will increase your CalFresh benefits. Please provide proof, such as, pay stubs, copies of checks, letters

from agencies, etc.

If you are reporting changes in expenses, please provide proof such as, receipts, canceled checks, paid invoices, etc.

•

•

Worker:

Phone:

MANDATORY REPORT OF INCOME OVER IRT

YOUR HOUSEHOLD IS ONLY REQUIRED TO REPORT CHANGES WHEN YOUR HOUSEHOLD’S TOTAL MONTHLY GROSS

INCOME EXCEEDS 130% OF THE FEDERAL POVERTY LEVEL. Your gross income means all of the money your household

receives including wages before taxes or other deductions, Social Security, SSI, cash contributions, unemployment compensation,

child support, worker’s compensation, etc. This change must be reported within 10 days of when the change occurred.

Failure to report this change may result in an overpayment of CalFresh benefits which you will have to repay.

You were told your IRT when your case was approved. If you are unsure of your household’s IRT, contact your local

county office.

To review a chart of gross income per household at 130% of the federal poverty level, visit:

To report a change, you may: Complete this form, sign it on the other side and return it to your local county office or contact

your local county office. If you need assistance in completing this form you may contact your local county office.

I want to report that:

■

My household’s gross monthly income is over 130% of the federal poverty level.

List the monthly income by each type received:

Is this new income to

How much each

When did it start?

Source of Money

Who gets it?

your household?

month?

Total gross monthly income is: $ ____________________.

■

■

Do you expect the changes in income you have reported will remain the same?

Yes

No

If you answer no, please explain:_____________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

CF 377.5 SAR (9/13) RECOMMENDED FORM

PAGE 1 OF 2

1

1 2

2