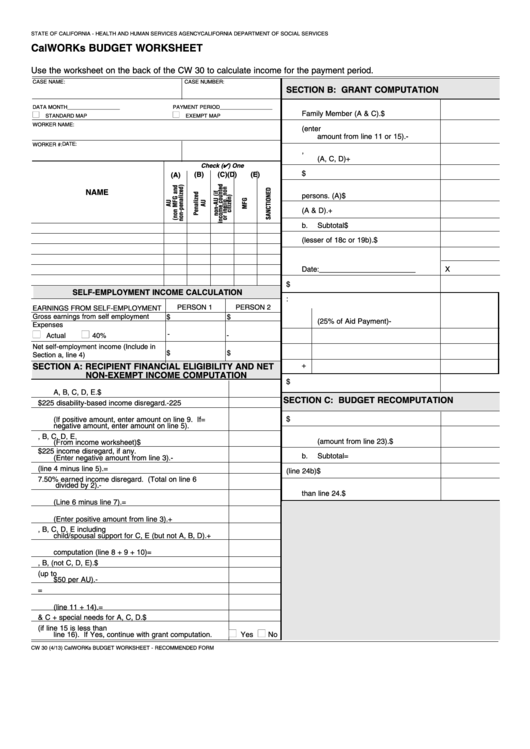

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CalWORKs BUDGET WORKSHEET

Use the worksheet on the back of the CW 30 to calculate income for the payment period.

CASE NAME:

CASE NUMBER:

SECTION B: GRANT COMPUTATION

18. Maximum Aid Payment for _______

DATA MONTH__________________

PAYMENT PERIOD__________________

■

■

Family Member (A & C).

$

STANDARD MAP

EXEMPT MAP

WORKER NAME:

a.

Net nonexempt income (enter

amount from line 11 or 15).

-

DATE:

WORKER #:

b.

Special needs other than HA,

(A, C, D)

+

Check (✔) One

c.

Potential Grant

$

(B)

(C)

(D)

(E)

(A)

19. Maximum Aid Payment for ______

NAME

persons. (A)

$

a.

Special Need other than HA (A & D).

+

b.

Subtotal

$

c.

Aid Payment (lesser of 18c or 19b).

$

20. Proration figure

Date:________________________

X

21. Prorated Aid Payment

$

SELF-EMPLOYMENT INCOME CALCULATION

22. Other adjustments imposed upon the AU:

PERSON 1

PERSON 2

EARNINGS FROM SELF-EMPLOYMENT

a.

Child Support non-co-op

Gross earnings from self employment

$

$

(25% of Aid Payment)

-

Expenses

■

■

-

Actual

40%

-

b.

Overpayment adjustment

-

Net self-employment income (Include in

c.

Cal-Learn penalties

-

$

$

Section a, line 4)

d.

Cal-Learn bonus

+

SECTION A: RECIPIENT FINANCIAL ELIGIBILITY AND NET

NON-EXEMPT INCOME COMPUTATION

23. Adjusted Aid Payment

$

1.

Total disability-based unearned income of

A, B, C, D, E.

$

SECTION C: BUDGET RECOMPUTATION

2.

Minus $225 disability-based income disregard.

-225

3.

Subtotal nonexempt disability-based income.

24. Actual Cash Aid Paid

$

(If positive amount, enter amount on line 9. If

=

negative amount, enter amount on line 5).

a.

Adjusted Aid Payment

4.

Gross averaged earned income of A, B, C, D, E.

(amount from line 23).

$

(From income worksheet)

$

5.

Remainder of $225 income disregard, if any.

b.

Subtotal

=

(Enter negative amount from line 3).

-

6.

Subtotal earned income (line 4 minus line 5).

=

25. Overpayment Amount (line 24b)

$

7.

50% earned income disregard. (Total on line 6

divided by 2).

-

26. Underpayment if line 23 is greater

than line 24.

$

8.

Subtotal net nonexempt earned income.

(Line 6 minus line 7).

=

9.

Nonexempt disability-based unearned income.

(Enter positive amount from line 3).

+

10. Other nonexempt income of A, B, C, D, E including

child/spousal support for C, E (but not A, B, D).

+

11. Total net nonexempt income for grant

computation (line 8 + 9 + 10)

=

12. Child/Spousal support for A, B, (not C, D, E).

$

13. Minus child/spousal support disregard (up to

$50 per AU).

-

14. Total countable child/spousal support

=

15. Total net nonexempt income for recipient test

(line 11 + 14).

=

16. MAP for A & C + special needs for A, C, D.

$

17. Family meets recipient test (if line 15 is less than

■

■

line 16). If Yes, continue with grant computation.

Yes

No

CW 30 (4/13) CalWORKs BUDGET WORKSHEET - RECOMMENDED FORM

1

1 2

2