Tourist Development Tax Return Form

ADVERTISEMENT

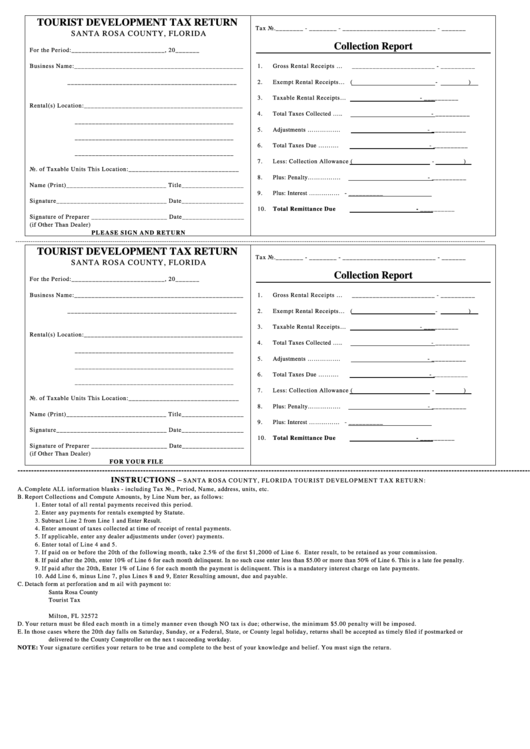

TOURIST DEVELOPMENT TAX RETURN

Tax No.________ - ________ - ___________________________ - _______

SANTA ROSA COUNTY, FLORIDA

Collection Report

For the Period:___________________________, 20_______

Business Name:_________________________________________________

1.

Gross Rental Receipts …

________________________ - __________

_________________________________________________

2.

Exem pt Rental Receipts… (

-

)

3.

Taxable Rental Receipts…

- __________

Rental(s) Location:______________________________________________

4.

Total Tax es C ollected … ..

- __________

______________________________________________

5.

Adj ustm ents … … … … … .

- __________

______________________________________________

6.

Total Tax es D ue … … … .

- __________

______________________________________________

7.

Less: Collection Allowance (

-

)

No. of Taxable Units This Location:________________________________

8.

Plus: P enalty… … … … … .

- __________

Nam e (Print)_____________________________ Title__________________

9.

Plus : Interes t … … … … …

- __________

Signature________________________________ Date__________________

10.

Total Rem ittance Due

- __________

Signature of Preparer ______________________ Date__________________

(if Other Than Dealer)

P L E A SE S IG N A N D R E TU R N

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TOURIST DEVELOPMENT TAX RETURN

Tax No.________ - ________ - ___________________________ - _______

SANTA ROSA COUNTY, FLORIDA

Collection Report

For the Period:___________________________, 20_______

Business Name:_________________________________________________

1.

Gross Rental Receipts …

________________________ - __________

_________________________________________________

2.

Exem pt Rental Receipts… (

-

)

3.

Taxable Rental Receipts…

- __________

Rental(s) Location:______________________________________________

4.

Total Tax es C ollected … ..

- __________

______________________________________________

5.

Adj ustm ents … … … … … .

- __________

______________________________________________

6.

Total Tax es D ue … … … .

- __________

______________________________________________

7.

Less: Collection Allowance (

-

)

No. of Taxable Units This Location:________________________________

8.

Plus: P enalty… … … … … .

- __________

Nam e (Print)_____________________________ Title__________________

9.

Plus : Interes t … … … … …

- __________

Signature________________________________ Date__________________

10.

Total Rem ittance Due

- __________

Signature of Preparer ______________________ Date__________________

(if Other Than Dealer)

FOR YOUR FILE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

INSTRUCT IONS –

S A N TA R O SA C O U N TY , F LO R ID A T O UR IS T D EV E LO P M E N T T A X R E TU R N :

A.

Com plete ALL information blanks - including Tax No., Period, Name, address, units, etc.

B.

Report Collections and Com pute Amoun ts, by Line Num ber, as follows:

1. Enter total of all rental payments received this period.

2. Enter any payments for rentals exempted by Statute.

3. S ubtr act Lin e 2 fr om Line 1 and En ter R esu lt.

4. Enter amount of taxes collected at time of receipt of rental payments.

5. If applicable, enter any dealer adjustments under (over) payments.

6. Enter total of Line 4 and 5.

7. If paid on or before the 20th of the following month, take 2.5% of the first $1,2000 of Line 6. Enter result, to be retained as your commission.

8. If pa id afte r the 2 0th, ente r 10 % of Line 6 for each m onth delinq uen t. In no s uch case ente r less th an $ 5.0 0 or m ore th an 5 0% of Line 6. T his is a late fe e pe nalty.

9. If paid after the 20th, Enter 1% of Line 6 for each month the payment is delinquent. This is a mandatory interest charge on late payments.

10. Add Line 6, minus Line 7, plus Lines 8 and 9, Enter Resulting amount, due and payable.

C.

Detach form at perforation and m ail with payment to:

San ta R osa C oun ty

Tourist Tax

P.O. Box 472

Milton, FL 32572

D.

Your return must be filed each month in a timely manner even though NO tax is due; otherwise, the minimum $5.00 penalty will be imposed.

E.

In those cases whe re the 20th day falls on Saturday, Sun day, or a Federal, State, or County legal holiday, returns shall be accepted as timely filed if postmarked or

delive red to the C oun ty Co m ptroller o n the nex t suc ceed ing w orkd ay.

NO TE : Your signature certifies your return to be true and complete to the best of your knowledge and belief. You must sign the return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1