S

N

J

TATE

EW

ERSEY

OF

D

T

EPARTMENT OF THE

REASURY

D

T

IVISION OF

AXATION

PO BOX 187

T

, NJ

RENTON

08695-0187

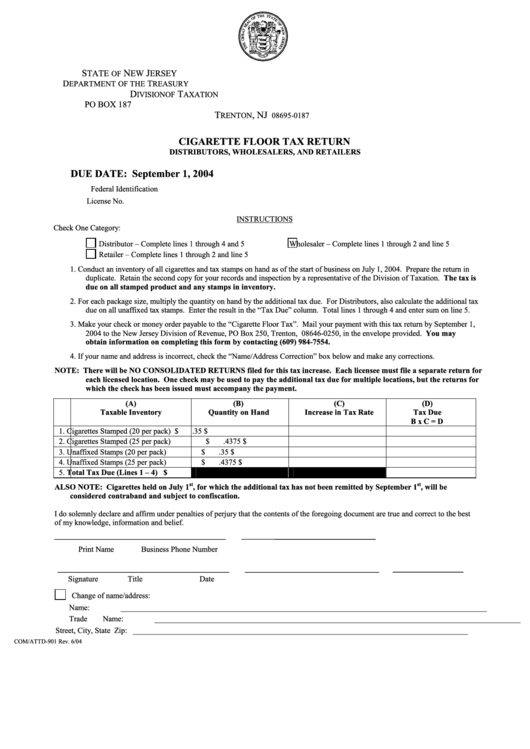

CIGARETTE FLOOR TAX RETURN

DISTRIBUTORS, WHOLESALERS, AND RETAILERS

DUE DATE: September 1, 2004

Federal Identification

License No.

INSTRUCTIONS

Check One Category:

Distributor – Complete lines 1 through 4 and 5

Wholesaler – Complete lines 1 through 2 and line 5

Retailer – Complete lines 1 through 2 and line 5

1.

Conduct an inventory of all cigarettes and tax stamps on hand as of the start of business on July 1, 2004. Prepare the return in

duplicate. Retain the second copy for your records and inspection by a representative of the Division of Taxation. The tax is

due on all stamped product and any stamps in inventory.

2.

For each package size, multiply the quantity on hand by the additional tax due. For Distributors, also calculate the additional tax

due on all unaffixed tax stamps. Enter the result in the “Tax Due” column. Total lines 1 through 4 and enter sum on line 5.

3.

Make your check or money order payable to the “Cigarette Floor Tax”. Mail your payment with this tax return by September 1,

2004 to the New Jersey Division of Revenue, PO Box 250, Trenton, N.J. 08646-0250, in the envelope provided. You may

obtain information on completing this form by contacting (609) 984-7554.

4.

If your name and address is incorrect, check the “Name/Address Correction” box below and make any corrections.

NOTE: There will be NO CONSOLIDATED RETURNS filed for this tax increase. Each licensee must file a separate return for

each licensed location. One check may be used to pay the additional tax due for multiple locations, but the returns for

which the check has been issued must accompany the payment.

(A)

(B)

(C)

(D)

Taxable Inventory

Quantity on Hand

Increase in Tax Rate

Tax Due

B x C = D

1.

Cigarettes Stamped (20 per pack)

$

.35

$

2.

Cigarettes Stamped (25 per pack)

$

.4375

$

3.

Unaffixed Stamps (20 per pack)

$

.35

$

4.

Unaffixed Stamps (25 per pack)

$

.4375

$

5.

Total Tax Due (Lines 1 – 4)

$

st

st

ALSO NOTE: Cigarettes held on July 1

, for which the additional tax has not been remitted by September 1

, will be

considered contraband and subject to confiscation.

I do solemnly declare and affirm under penalties of perjury that the contents of the foregoing document are true and correct to the best

of my knowledge, information and belief.

Print Name

Business Phone Number

Signature

Title

Date

Change of name/address:

Name:

______________________________________________________________________________________________

Trade Name: ______________________________________________________________________________________________

Street, City, State Zip: ______________________________________________________________________________________

COM/ATTD-901 Rev. 6/04

1

1