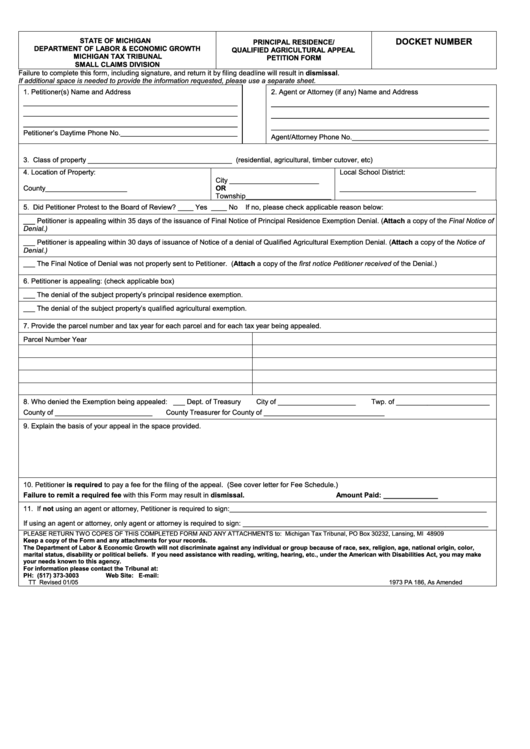

STATE OF MICHIGAN

DOCKET NUMBER

PRINCIPAL RESIDENCE/

DEPARTMENT OF LABOR & ECONOMIC GROWTH

QUALIFIED AGRICULTURAL APPEAL

MICHIGAN TAX TRIBUNAL

PETITION FORM

SMALL CLAIMS DIVISION

Failure to complete this form, including signature, and return it by filing deadline will result in dismissal.

If additional space is needed to provide the information requested, please use a separate sheet.

1. Petitioner(s) Name and Address

2. Agent or Attorney (if any) Name and Address

_______________________________________________________

__________________________________________________

_______________________________________________________

__________________________________________________

_______________________________________________________

__________________________________________________

Petitioner’s Daytime Phone No.______________________________

Agent/Attorney Phone No.___________________________________

3. Class of property _____________________________________ (residential, agricultural, timber cutover, etc)

4. Location of Property:

Local School District:

City _______________________

County_____________________

OR

___________________________________

Township______________________

5. Did Petitioner Protest to the Board of Review? ____ Yes ____ No

If no, please check applicable reason below:

___ Petitioner is appealing within 35 days of the issuance of Final Notice of Principal Residence Exemption Denial. (Attach a copy of the Final Notice of

Denial.)

___ Petitioner is appealing within 30 days of issuance of Notice of a denial of Qualified Agricultural Exemption Denial. (Attach a copy of the Notice of

Denial.)

___ The Final Notice of Denial was not properly sent to Petitioner. (Attach a copy of the first notice Petitioner received of the Denial.)

6. Petitioner is appealing: (check applicable box)

___ The denial of the subject property’s principal residence exemption.

___ The denial of the subject property’s qualified agricultural exemption.

7. Provide the parcel number and tax year for each parcel and for each tax year being appealed.

Parcel Number

Year

8. Who denied the Exemption being appealed: ___ Dept. of Treasury

City of ____________________

Twp. of ________________________

County of _________________________

County Treasurer for County of _______________________________

9. Explain the basis of your appeal in the space provided.

10. Petitioner is required to pay a fee for the filing of the appeal. (See cover letter for Fee Schedule.)

Failure to remit a required fee with this Form may result in dismissal.

Amount Paid: ______________

11. If not using an agent or attorney, Petitioner is required to sign:__________________________________________________________________

If using an agent or attorney, only agent or attorney is required to sign: _______________________________________________________________

PLEASE RETURN TWO COPES OF THIS COMPLETED FORM AND ANY ATTACHMENTS to: Michigan Tax Tribunal, PO Box 30232, Lansing, MI 48909

Keep a copy of the Form and any attachments for your records.

The Department of Labor & Economic Growth will not discriminate against any individual or group because of race, sex, religion, age, national origin, color,

marital status, disability or political beliefs. If you need assistance with reading, writing, hearing, etc., under the American with Disabilities Act, you may make

your needs known to this agency.

For information please contact the Tribunal at:

PH: (517) 373-3003

Web Site:

E-mail: taxtrib@Michigan.gov

TT Revised 01/05

1973 PA 186, As Amended

1

1