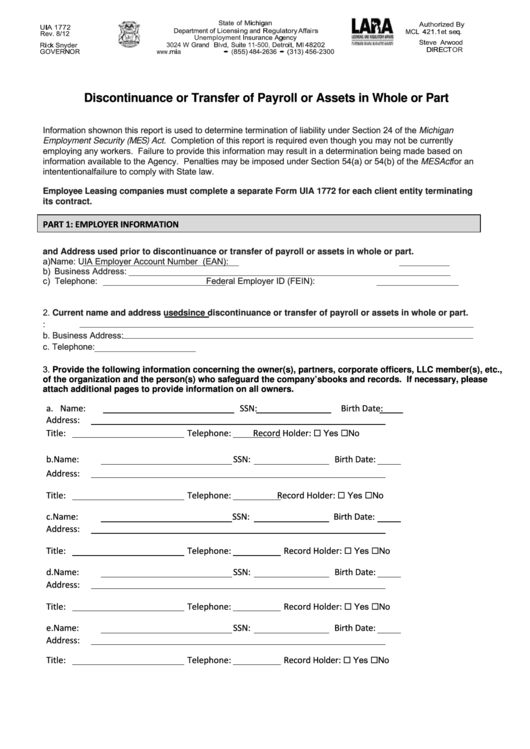

State of Michigan

Authorized By

UIA 1772

Department

of

Licensing

and

Regulatory Affairs

MCL 421.1 et

seq.

Rev. 8/12

Unemployment

Insurance Agency

Steve Arwood

3024 W

Grand

Blvd,

Suite

11-500, Detroit,

Ml

48202

Rick

Snyder

DIRECTOR

GOVERNOR

•

(855) 484-2636

•

(313) 456-2300

Reset Form

Discontinuance or Transfer of Payroll or Assets in Whole or Part

Information shown on this report is used to determine termination of liability under Section 24 of the Michigan

Employment Security (MES) Act. Completion of this report is required even though you may not be currently

employing any workers. Failure to provide this information may result in a determination being made based on

information available to the Agency. Penalties may be imposed under Section 54(a) or 54(b) of the MES Act for an

intententional failure to comply with State law.

Employee Leasing companies must complete a separate Form UIA 1772 for each client entity terminating

its contract.

PART 1: EMPLOYER INFORMATION

1. Name and Address used prior to discontinuance or transfer of payroll or assets in whole or part.

a) Name:

UIA Employer Account Number (EAN):

b) Business Address:

c) Telephone:

Federal Employer ID (FEIN):

2. Current name and address used since discontinuance or transfer of payroll or assets in whole or part.

a. Name:

b. Business Address:

c. Telephone:

3. Provide the following information concerning the owner(s), partners, corporate officers, LLC member(s), etc.,

of the organization and the person(s) who safeguard the company’s books and records. If necessary, please

attach additional pages to provide information on all owners.

a. Name:

SSN:

Birth Date:

Address:

Title:

Telephone:

Record Holder:

Yes No

b. Name:

SSN:

Birth Date:

Address:

Title:

Telephone:

Record Holder:

Yes No

c. Name:

SSN:

Birth Date:

Address:

Title:

Telephone:

Record Holder:

Yes No

d. Name:

SSN:

Birth Date:

Address:

Title:

Telephone:

Record Holder:

Yes No

e. Name:

SSN:

Birth Date:

Address:

Title:

Telephone:

Record Holder:

Yes No

1

1 2

2 3

3 4

4