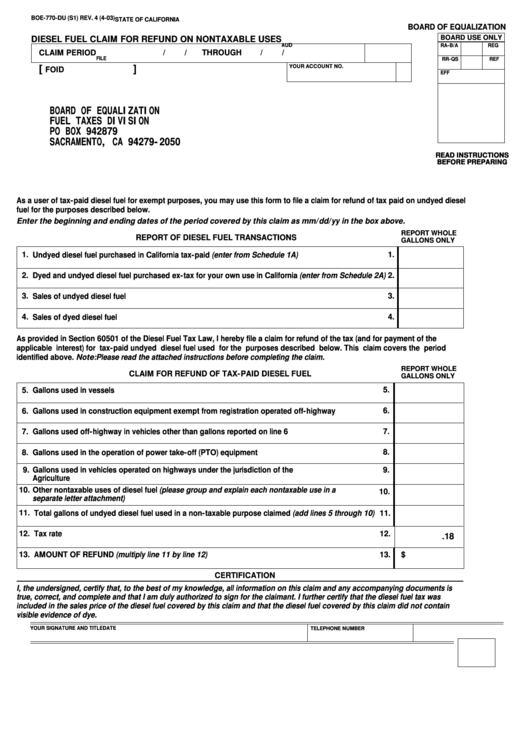

BOE-770-DU (S1) REV. 4 (4-03)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

BOARD USE ONLY

DIESEL FUEL CLAIM FOR REFUND ON NONTAXABLE USES

RA-B/A

AUD

REG

/

/

THROUGH

/

/

CLAIM PERIOD

FILE

RR-QS

REF

[

]

YOUR ACCOUNT NO.

FOID

EFF

BOARD OF EQUALIZATION

FUEL TAXES DIVISION

PO BOX 942879

SACRAMENTO, CA 94279-2050

READ INSTRUCTIONS

READ INSTRUCTIONS

BEFORE PREPARING

BEFORE PREPARING

As a user of tax-paid diesel fuel for exempt purposes, you may use this form to file a claim for refund of tax paid on undyed diesel

fuel for the purposes described below.

Enter the beginning and ending dates of the period covered by this claim as mm/dd/yy in the box above.

REPORT WHOLE

REPORT OF DIESEL FUEL TRANSACTIONS

GALLONS ONLY

1.

Undyed diesel fuel purchased in California tax-paid (enter from Schedule 1A)

1.

2.

2.

Dyed and undyed diesel fuel purchased ex-tax for your own use in California (enter from Schedule 2A)

3.

Sales of undyed diesel fuel

3.

4.

Sales of dyed diesel fuel

4.

As provided in Section 60501 of the Diesel Fuel Tax Law, I hereby file a claim for refund of the tax (and for payment of the

applicable interest) for tax-paid undyed diesel fuel used for the purposes described below. This claim covers the period

identified above. Note: Please read the attached instructions before completing the claim.

REPORT WHOLE

CLAIM FOR REFUND OF TAX-PAID DIESEL FUEL

GALLONS ONLY

5.

5.

Gallons used in vessels

6.

6.

Gallons used in construction equipment exempt from registration operated off-highway

7.

7.

Gallons used off-highway in vehicles other than gallons reported on line 6

8.

Gallons used in the operation of power take-off (PTO) equipment

8.

Gallons used in vehicles operated on highways under the jurisdiction of the U.S. Department of

9.

9.

Agriculture

10.

Other nontaxable uses of diesel fuel (please group and explain each nontaxable use in a

10.

separate letter attachment)

11.

Total gallons of undyed diesel fuel used in a non-taxable purpose claimed (add lines 5 through 10)

11.

12.

Tax rate

12.

.18

13.

AMOUNT OF REFUND (multiply line 11 by line 12)

13.

$

CERTIFICATION

I, the undersigned, certify that, to the best of my knowledge, all information on this claim and any accompanying documents is

true, correct, and complete and that I am duly authorized to sign for the claimant. I further certify that the diesel fuel tax was

included in the sales price of the diesel fuel covered by this claim and that the diesel fuel covered by this claim did not contain

visible evidence of dye.

YOUR SIGNATURE AND TITLE

TELEPHONE NUMBER

DATE

CONTINUE

1

1 2

2 3

3 4

4