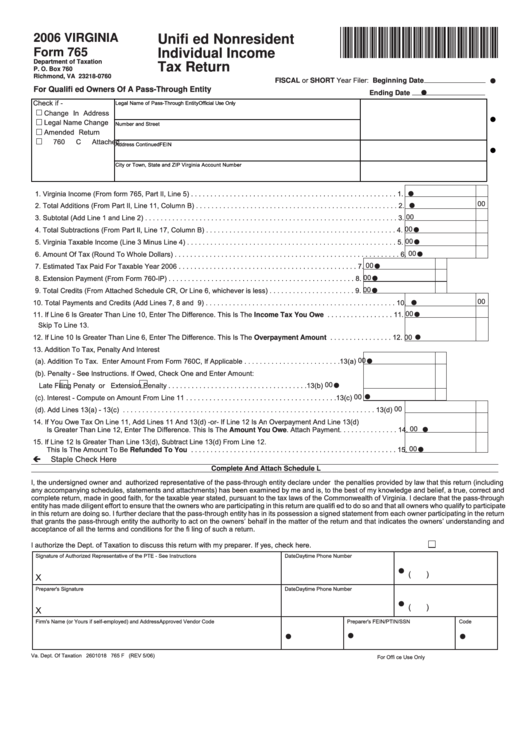

Form 765 - Unified Nonresident Individual Income Tax Return - 2006

ADVERTISEMENT

2006 VIRGINIA

Unifi ed Nonresident

Form 765

Individual Income

Department of Taxation

Tax Return

P. O. Box 760

Richmond, VA 23218-0760

w

FISCAL or SHORT Year Filer: Beginning Date

For Qualifi ed Owners Of A Pass-Through Entity

w

Ending Date

Check if -

Legal Name of Pass-Through Entity

Official Use Only

Change In Address

w

Legal Name Change

Number and Street

Amended Return

760 C Attached

Address Continued

FEIN

w

City or Town, State and ZIP

Virginia Account Number

w

1. Virginia Income (From form 765, Part II, Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

00

w

2. Total Additions (From Part II, Line 11, Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

00

3. Subtotal (Add Line 1 and Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

00

w

4. Total Subtractions (From Part II, Line 17, Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

00

w

5. Virginia Taxable Income (Line 3 Minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

w

00

6. Amount Of Tax (Round To Whole Dollars) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

00

w

7. Estimated Tax Paid For Taxable Year 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

00

w

8. Extension Payment (From Form 760-IP) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

w

00

9. Total Credits (From Attached Schedule CR, Or Line 6, whichever is less) . . . . . . . . . . . . . . . . . . . . . . 9.

00

w

10. Total Payments and Credits (Add Lines 7, 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

w

00

11. If Line 6 Is Greater Than Line 10, Enter The Difference. This Is The Income Tax You Owe . . . . . . . . . . . . . . . . . 11.

Skip To Line 13.

w

12. If Line 10 Is Greater Than Line 6, Enter The Difference. This Is The Overpayment Amount . . . . . . . . . . . . . . . . 12.

00

13. Addition To Tax, Penalty And Interest

w

00

(a). Addition To Tax. Enter Amount From Form 760C, If Applicable . . . . . . . . . . . . . . . . . . . . . . . . .13(a)

(b). Penalty - See Instructions. If Owed, Check One and Enter Amount:

00

w

Late Filing Penaty or

Extension Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13(b)

w

00

(c). Interest - Compute on Amount From Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13(c)

00

(d). Add Lines 13(a) - 13(c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13(d)

14. If You Owe Tax On Line 11, Add Lines 11 And 13(d) -or- If Line 12 Is An Overpayment And Line 13(d)

00

w

Is Greater Than Line 12, Enter The Difference. This Is The Amount You Owe. Attach Payment. . . . . . . . . . . . . . . 14.

15. If Line 12 Is Greater Than Line 13(d), Subtract Line 13(d) From Line 12.

00

w

This Is The Amount To Be Refunded To You . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

Staple Check Here

Complete And Attach Schedule L

I, the undersigned owner and authorized representative of the pass-through entity declare under the penalties provided by law that this return (including

any accompanying schedules, statements and attachments) has been examined by me and is, to the best of my knowledge and belief, a true, correct and

complete return, made in good faith, for the taxable year stated, pursuant to the tax laws of the Commonwealth of Virginia. I declare that the pass-through

entity has made diligent effort to ensure that the owners who are participating in this return are qualifi ed to do so and that all owners who qualify to participate

in this return are doing so. I further declare that the pass-through entity has in its possession a signed statement from each owner participating in the return

that grants the pass-through entity the authority to act on the owners’ behalf in the matter of the return and that indicates the owners’ understanding and

acceptance of all the terms and conditions for the fi ling of such a return.

I authorize the Dept. of Taxation to discuss this return with my preparer. If yes, check here.

Signature of Authorized Representative of the PTE - See Instructions

Date

Daytime Phone Number

●

(

)

X

Preparer's Signature

Date

Daytime Phone Number

●

(

)

X

Firm's Name (or Yours if self-employed) and Address

Approved Vendor Code

Preparer's FEIN/PTIN/SSN

Code

●

●

●

Va. Dept. Of Taxation 2601018 765 F (REV 5/06)

For Offi ce Use Only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3