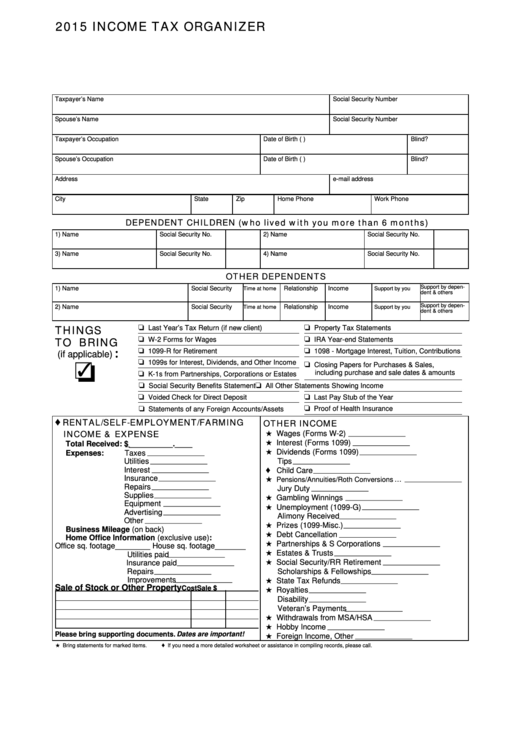

201 5 INCOME TAX ORGANIZER

Taxpayer’s Name

Social Security Number

Spouse’s Name

Social Security Number

Taxpayer’s Occupation

Date of Birth (D.O.B.)

Blind?

Spouse’s Occupation

Date of Birth (D.O.B.)

Blind?

Address

e-mail address

City

State

Zip

Home Phone

Work Phone

DEPENDENT CHILDREN (who lived with you more than 6 months)

1) Name

Social Security No.

D.O.B.

2) Name

Social Security No.

D.O.B.

3) Name

Social Security No.

D.O.B.

4) Name

Social Security No.

D.O.B.

OTHER DEPENDENTS

Support by depen-

1) Name

Social Security

Relationship

Income

Time at home

Support by you

dent & others

Support by depen-

2) Name

Social Security

Relationship

Income

Time at home

Support by you

dent & others

THINGS

❏

❏

Last Year’s Tax Return (if new client)

Property Tax Statements

TO BRING

❏

❏

W-2 Forms for Wages

IRA Year-end Statements

:

❏

❏

1099-R for Retirement

1098 - Mortgage Interest, Tuition, Contributions

(if applicable)

❏

❏

1099s for Interest, Dividends, and Other Income

❏

✓

Closing Papers for Purchases & Sales,

including purchase and sale dates & amounts

❏

K-1s from Partnerships, Corporations or Estates

❏

❏

Social Security Benefits Statement

All Other Statements Showing Income

❏

❏

Voided Check for Direct Deposit

Last Pay Stub of the Year

❏

❏

Proof of Health Insurance

Statements of any Foreign Accounts/Assets

RENTAL/SELF-EMPLOYMENT/FARMING

OTHER INCOME

♦

INCOME & EXPENSE

★ Wages (Forms W-2) ....................... _____________

★ Interest (Forms 1099) ..................... _____________

Total Received: $ __________.____

★ Dividends (Forms 1099).................. _____________

Taxes .................... _____________

Expenses:

Utilities................... _____________

Tips ............................................... _____________

Interest .................. _____________

♦ Child Care...................................... _____________

Insurance............... _____________

★

_____________

Pensions/Annuities/Roth Conversions ...

Repairs.................. _____________

Jury Duty ....................................... _____________

Supplies................. _____________

★ Gambling Winnings ........................ _____________

Equipment ............. _____________

★ Unemployment (1099-G)................. _____________

Advertising............. _____________

Alimony Received........................... _____________

Other ..................... _____________

★ Prizes (1099-Misc.)......................... _____________

Business Mileage (on back)

★ Debt Cancellation ........................... _____________

Home Office Information (exclusive use):

★ Partnerships & S Corporations ........ _____________

Office sq. footage

________ House sq. footage _______

★ Estates & Trusts............................. _____________

Utilities paid........... _____________

★ Social Security/RR Retirement ........ _____________

Insurance paid....... _____________

Repairs ................. _____________

Scholarships & Fellowships............. _____________

Improvements........ _____________

★ State Tax Refunds.......................... _____________

Sale of Stock or Other Property

Cost

Sale $

★ Royalties........................................ _____________

Disability ........................................ _____________

Veteran’s Payments........................ _____________

★ Withdrawals from MSA/HSA............ _____________

★ Hobby Income................................ _____________

Please bring supporting documents. Dates are important!

★ Foreign Income, Other .................... _____________

★ Bring statements for marked items.

♦ If you need a more detailed worksheet or assistance in compiling records, please call.

1

1 2

2