Complete and use the button at the end to print for mailing.

HELP

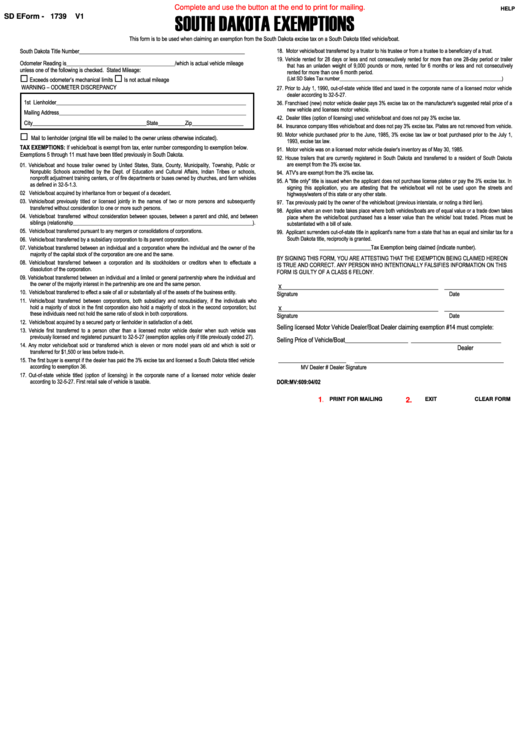

SOUTH DAKOTA EXEMPTIONS

SD EForm - 1739

V1

This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicle/boat.

South Dakota Title Number _____________________________________________________________

18. Motor vehicle/boat transferred by a trustor to his trustee or from a trustee to a beneficiary of a trust.

19. Vehicle rented for 28 days or less and not consecutively rented for more than one 28-day period or trailer

Odometer Reading is ________________________________________ /which is actual vehicle mileage

that has an unladen weight of 9,000 pounds or more, rented for 6 months or less and not consecutively

unless one of the following is checked. Stated Mileage:

rented for more than one 6 month period.

(List SD Sales Tax number __________________________________________________________________ )

Exceeds odometer’s mechanical limits

Is not actual mileage

WARNING – ODOMETER DISCREPANCY

27. Prior to July 1, 1990, out-of-state vehicle titled and taxed in the corporate name of a licensed motor vehicle

dealer according to 32-5-27.

1st Lienholder ______________________________________________________________________

36. Franchised (new) motor vehicle dealer pays 3% excise tax on the manufacturer's suggested retail price of a

new vehicle and licenses motor vehicle.

Mailing Address _____________________________________________________________________

42. Dealer titles (option of licensing) used vehicle/boat and does not pay 3% excise tax.

City__________________________________________ State __________Zip ___________________

84. Insurance company titles vehicle/boat and does not pay 3% excise tax. Plates are not removed from vehicle.

90. Motor vehicle purchased prior to the June, 1985, 3% excise tax law or boat purchased prior to the July 1,

Mail to lienholder (original title will be mailed to the owner unless otherwise indicated).

1993, excise tax law.

TAX EXEMPTIONS: If vehicle/boat is exempt from tax, enter number corresponding to exemption below.

91. Motor vehicle was on a licensed motor vehicle dealer's inventory as of May 30, 1985.

Exemptions 5 through 11 must have been titled previously in South Dakota.

92. House trailers that are currently registered in South Dakota and transferred to a resident of South Dakota

are exempt from the 3% excise tax.

01. Vehicle/boat and house trailer owned by United States, State, County, Municipality, Township, Public or

Nonpublic Schools accredited by the Dept. of Education and Cultural Affairs, Indian Tribes or schools,

94. ATV's are exempt from the 3% excise tax.

nonprofit adjustment training centers, or of fire departments or buses owned by churches, and farm vehicles

95. A "title only" title is issued when the applicant does not purchase license plates or pay the 3% excise tax. In

as defined in 32-5-1.3.

signing this application, you are attesting that the vehicle/boat will not be used upon the streets and

02 Vehicle/boat acquired by inheritance from or bequest of a decedent.

highways/waters of this state or any other state.

03. Vehicle/boat previously titled or licensed jointly in the names of two or more persons and subsequently

97. Tax previously paid by the owner of the vehicle/boat (previous interstate, or noting a third lien).

transferred without consideration to one or more such persons.

98. Applies when an even trade takes place where both vehicles/boats are of equal value or a trade down takes

04. Vehicle/boat transferred without consideration between spouses, between a parent and child, and between

place where the vehicle/boat purchased has a lesser value than the vehicle/ boat traded. Prices must be

siblings (relationship____________________________________________________________________).

substantiated with a bill of sale.

05. Vehicle/boat transferred pursuant to any mergers or consolidations of corporations.

99. Applicant surrenders out-of-state title in applicant's name from a state that has an equal and similar tax for a

South Dakota title, reciprocity is granted.

06. Vehicle/boat transferred by a subsidiary corporation to its parent corporation.

___________________ Tax Exemption being claimed (indicate number).

07. Vehicle/boat transferred between an individual and a corporation where the individual and the owner of the

majority of the capital stock of the corporation are one and the same.

BY SIGNING THIS FORM, YOU ARE ATTESTING THAT THE EXEMPTION BEING CLAIMED HEREON

08. Vehicle/boat transferred between a corporation and its stockholders or creditors when to effectuate a

IS TRUE AND CORRECT. ANY PERSON WHO INTENTIONALLY FALSIFIES INFORMATION ON THIS

dissolution of the corporation.

FORM IS GUILTY OF A CLASS 6 FELONY.

09. Vehicle/boat transferred between an individual and a limited or general partnership where the individual and

the owner of the majority interest in the partnership are one and the same person.

___________________________________________________________

X

______________________

10. Vehicle/boat transferred to effect a sale of all or substantially all of the assets of the business entity.

Signature

Date

11. Vehicle/boat transferred between corporations, both subsidiary and nonsubsidiary, if the individuals who

hold a majority of stock in the first corporation also hold a majority of stock in the second corporation; but

X

___________________________________________________________

______________________

these individuals need not hold the same ratio of stock in both corporations.

Signature

Date

12. Vehicle/boat acquired by a secured party or lienholder in satisfaction of a debt.

Selling licensed Motor Vehicle Dealer/Boat Dealer claiming exemption #14 must complete:

13. Vehicle first transferred to a person other than a licensed motor vehicle dealer when such vehicle was

previously licensed and registered pursuant to 32-5-27 (exemption applies only if title previously coded 27).

Selling Price of Vehicle/Boat _____________________ ______________________________

14. Any motor vehicle/boat sold or transferred which is eleven or more model years old and which is sold or

Dealer

transferred for $1,500 or less before trade-in.

15. The first buyer is exempt if the dealer has paid the 3% excise tax and licensed a South Dakota titled vehicle

_________________________

_______________________________________________________

according to exemption 36.

MV Dealer #

Dealer Signature

17. Out-of-state vehicle titled (option of licensing) in the corporate name of a licensed motor vehicle dealer

according to 32-5-27. First retail sale of vehicle is taxable.

DOR:MV:609:04/02

1.

PRINT FOR MAILING

EXIT

CLEAR FORM

2.

1

1