Annual Privilege License Tax Return For Construction Trade Licenses - City Of Huntsville, Alabama

ADVERTISEMENT

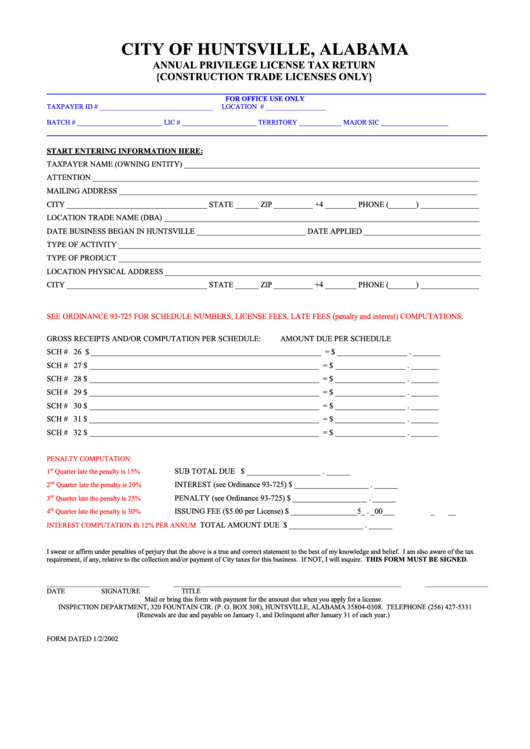

CITY OF HUNTSVILLE, ALABAMA

ANNUAL PRIVILEGE LICENSE TAX RETURN

{CONSTRUCTION TRADE LICENSES ONLY}

____________________________________________________________________________________

FOR OFFICE USE ONLY

TAXPAYER ID # ________________________________

LOCATION # _________________

BATCH # ________________________

LIC # _____________________ TERRITORY ____________

MAJOR SIC ___________________

____________________________________________________________________________________________________

START ENTERING INFORMATION HERE:

TAXPAYER NAME (OWNING ENTITY) ____________________________________________________________________________

ATTENTION ___________________________________________________________________________________________________

MAILING ADDRESS ____________________________________________________________________________________________

CITY ____________________________________ STATE ______ ZIP __________ +4 ________ PHONE (_______) _______________

LOCATION TRADE NAME (DBA) _________________________________________________________________________________

DATE BUSINESS BEGAN IN HUNTSVILLE ____________________________ DATE APPLIED ______________________________

TYPE OF ACTIVITY _____________________________________________________________________________________________

TYPE OF PRODUCT _____________________________________________________________________________________________

LOCATION PHYSICAL ADDRESS _________________________________________________________________________________

CITY ____________________________________ STATE ______ ZIP __________ +4 ________ PHONE (_______) _______________

SEE ORDINANCE 93-725 FOR SCHEDULE NUMBERS, LICENSE FEES, LATE FEES (penalty and interest)

COMPUTATIONS.

GROSS RECEIPTS AND/OR COMPUTATION PER SCHEDULE:

AMOUNT DUE PER SCHEDULE

SCH # 26

$ ___________________________________________________________ = $ __________________ . _______

SCH # 27

$ ___________________________________________________________ = $ __________________ . _______

SCH # 28

$ ___________________________________________________________ = $ __________________ . _______

SCH # 29

$ ___________________________________________________________ = $ __________________ . _______

SCH # 30

$ ___________________________________________________________ = $ __________________ . _______

SCH # 31

$ ___________________________________________________________ = $ __________________ . _______

SCH # 32

$ ___________________________________________________________ = $ __________________ . _______

PENALTY COMPUTATION:

st

SUB TOTAL DUE

$ ___________________ . ______

1

Quarter late the penalty is 15%

INTEREST (see Ordinance 93-725)

$ ___________________ . ______

nd

2

Quarter late the penalty is 20%

rd

PENALTY (see Ordinance 93-725)

$ ___________________ . ______

3

Quarter late the penalty is 25%

th

ISSUING FEE ($5.00 per License)

$ _________________5_ . _00___

4

Quarter late the penalty is 30%

TOTAL AMOUNT DUE

$ ___________________ . ______

INTEREST COMPUTATION IS 12% PER ANNUM

I swear or affirm under penalties of perjury that the above is a true and correct statement to the best of my knowledge and belief. I am also aware of the tax

requirement, if any, relative to the collection and/or payment of City taxes for this business. If NOT, I will inquire. THIS FORM MUST BE SIGNED.

_____________________________

________________________________________________________________

__________________

DATE

SIGNATURE

TITLE

Mail or bring this form with payment for the amount due when you apply for a license.

INSPECTION DEPARTMENT, 320 FOUNTAIN CIR. (P. O. BOX 308), HUNTSVILLE, ALABAMA 35804-0308. TELEPHONE (256) 427-5331

(Renewals are due and payable on January 1, and Delinquent after January 31 of each year.)

FORM DATED 1/2/2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1