PRINT

RESET

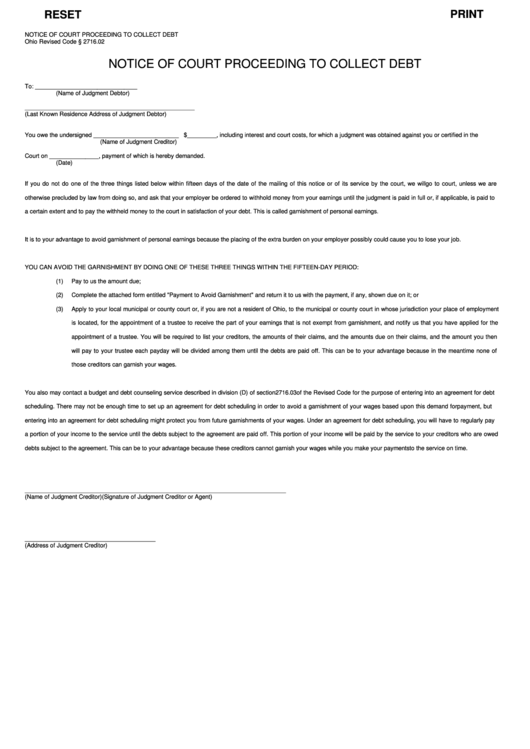

NOTICE OF COURT PROCEEDING TO COLLECT DEBT

Ohio Revised Code § 2716.02

NOTICE OF COURT PROCEEDING TO COLLECT DEBT

To: _______________________________

(Name of Judgment Debtor)

____________________________________________________

(Last Known Residence Address of Judgment Debtor)

You owe the undersigned __________________________ $_________, including interest and court costs, for which a judgment was obtained against you or certified in the

(Name of Judgment Creditor)

Court on _______________, payment of which is hereby demanded.

(Date)

If you do not do one of the three things listed below within fifteen days of the date of the mailing of this notice or of its service by the court, we will go to court, unless we are

otherwise precluded by law from doing so, and ask that your employer be ordered to withhold money from your earnings until the judgment is paid in full or, if applicable, is paid to

a certain extent and to pay the withheld money to the court in satisfaction of your debt. This is called garnishment of personal earnings.

It is to your advantage to avoid garnishment of personal earnings because the placing of the extra burden on your employer possibly could cause you to lose your job.

YOU CAN AVOID THE GARNISHMENT BY DOING ONE OF THESE THREE THINGS WITHIN THE FIFTEEN-DAY PERIOD:

(1)

Pay to us the amount due;

(2)

Complete the attached form entitled "Payment to Avoid Garnishment" and return it to us with the payment, if any, shown due on it; or

(3)

Apply to your local municipal or county court or, if you are not a resident of Ohio, to the municipal or county court in whose jurisdiction your place of employment

is located, for the appointment of a trustee to receive the part of your earnings that is not exempt from garnishment, and notify us that you have applied for the

appointment of a trustee. You will be required to list your creditors, the amounts of their claims, and the amounts due on their claims, and the amount you then

will pay to your trustee each payday will be divided among them until the debts are paid off. This can be to your advantage because in the meantime none of

those creditors can garnish your wages.

You also may contact a budget and debt counseling service described in division (D) of section 2716.03 of the Revised Code for the purpose of entering into an agreement for debt

scheduling. There may not be enough time to set up an agreement for debt scheduling in order to avoid a garnishment of your wages based upon this demand for payment, but

entering into an agreement for debt scheduling might protect you from future garnishments of your wages. Under an agreement for debt scheduling, you will have to regularly pay

a portion of your income to the service until the debts subject to the agreement are paid off. This portion of your income will be paid by the service to your creditors who are owed

debts subject to the agreement. This can be to your advantage because these creditors cannot garnish your wages while you make your payments to the service on time.

________________________________________

________________________________________

(Name of Judgment Creditor)

(Signature of Judgment Creditor or Agent)

________________________________________

(Address of Judgment Creditor)

1

1 2

2