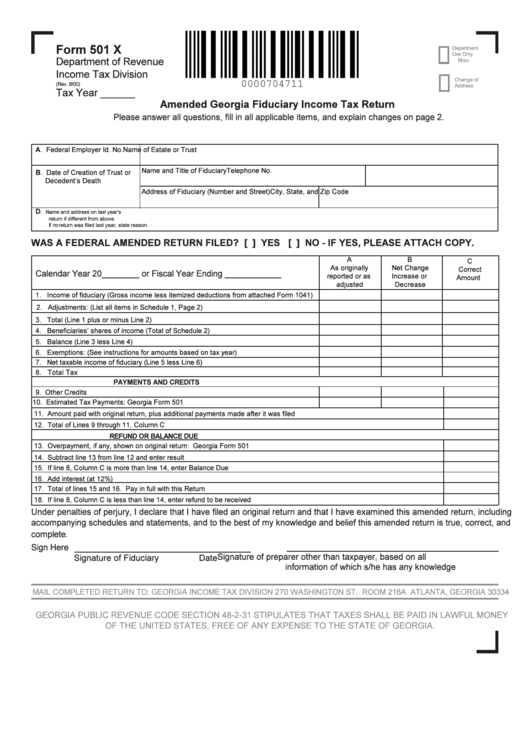

Form 501 X Amended Georgia Fiduciary Income Tax Return

ADVERTISEMENT

Form 501 X

Department

Use Only

Department of Revenue

Misc.

Income Tax Division

Change of

(Rev. 8/00)

Address

Tax Year ______

Amended Georgia Fiduciary Income Tax Return

Please answer all questions, fill in all applicable items, and explain changes on page 2.

A

B

D

Name and address on last year’s

return if different from above.

If no return was filed last year, state reason.

WAS A FEDERAL AMENDED RETURN FILED? [ ] YES [ ] NO - IF YES, PLEASE ATTACH COPY.

Calendar Year 20________ or Fiscal Year Ending ____________

PAYMENTS AND CREDITS

REFUND OR BALANCE DUE

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including

accompanying schedules and statements, and to the best of my knowledge and belief this amended return is true, correct, and

complete.

Sign Here

Signature of preparer other than taxpayer, based on all

Signature of Fiduciary

Date

information of which s/he has any knowledge

MAIL COMPLETED RETURN TO: GEORGIA INCOME TAX DIVISION 270 WASHINGTON ST. ROOM 216A ATLANTA, GEORGIA 30334

GEORGIA PUBLIC REVENUE CODE SECTION 48-2-31 STIPULATES THAT TAXES SHALL BE PAID IN LAWFUL MONEY

OF THE UNITED STATES, FREE OF ANY EXPENSE TO THE STATE OF GEORGIA.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2