Form 501 X Amended Georgia Fiduciary Income Tax Return

ADVERTISEMENT

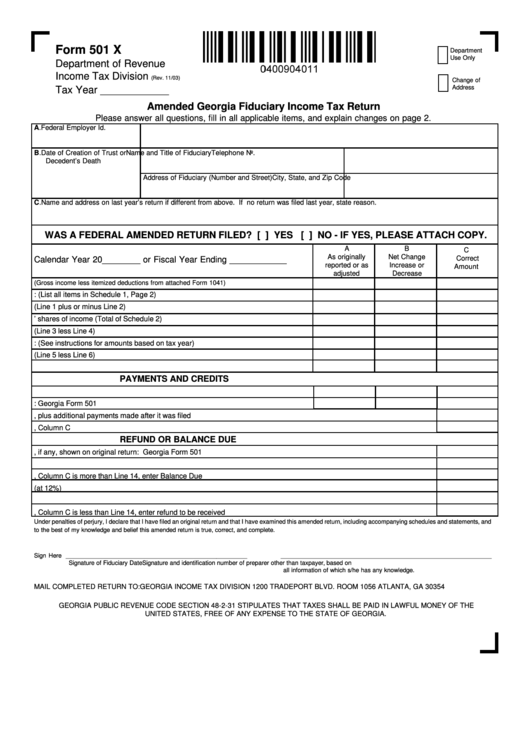

Form 501 X

Department

Use Only

Department of Revenue

Income Tax Division

(Rev. 11/03)

Change of

Address

Tax Year ____________

Amended Georgia Fiduciary Income Tax Return

Please answer all questions, fill in all applicable items, and explain changes on page 2.

A. Federal Employer Id. No.

Name of Estate or Trust

B. Date of Creation of Trust or

Name and Title of Fiduciary

Telephone No.

Decedent’s Death

Address of Fiduciary (Number and Street)

City, State, and Zip Code

C. Name and address on last year’s return if different from above. If no return was filed last year, state reason.

WAS A FEDERAL AMENDED RETURN FILED? [ ] YES [ ] NO - IF YES, PLEASE ATTACH COPY.

A

B

C

As originally

Net Change

Correct

Calendar Year 20________ or Fiscal Year Ending ____________

reported or as

Increase or

Amount

adjusted

Decrease

1. Income of fiduciary

(Gross income less itemized deductions from attached Form 1041)

2. Adjustments: (List all items in Schedule 1, Page 2)

3. Total (Line 1 plus or minus Line 2)

4. Beneficiaries’ shares of income (Total of Schedule 2)

5. Balance (Line 3 less Line 4)

6. Exemptions: (See instructions for amounts based on tax year)

7. Net taxable income of fiduciary (Line 5 less Line 6)

8. Total Tax

PAYMENTS AND CREDITS

9. Other Credits

10. Estimated Tax Payments: Georgia Form 501

11. Amount paid with original return, plus additional payments made after it was filed

12. Total of Lines 9 through 11, Column C

REFUND OR BALANCE DUE

13. Overpayment, if any, shown on original return: Georgia Form 501

14. Subtract Line 13 from Line 12 and enter result

15. If Line 8, Column C is more than Line 14, enter Balance Due

16. Add interest (at 12%)

17. Total of Lines 15 and 16. Pay in full with this Return

18. If Line 8, Column C is less than Line 14, enter refund to be received

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying schedules and statements, and

to the best of my knowledge and belief this amended return is true, correct, and complete.

Sign Here

_____________________________________________________

_____________________________________________________________

Signature of Fiduciary

Date

Signature and identification number of preparer other than taxpayer, based on

all information of which s/he has any knowledge.

MAIL COMPLETED RETURN TO: GEORGIA INCOME TAX DIVISION 1200 TRADEPORT BLVD. ROOM 1056 ATLANTA, GA 30354

GEORGIA PUBLIC REVENUE CODE SECTION 48-2-31 STIPULATES THAT TAXES SHALL BE PAID IN LAWFUL MONEY OF THE

UNITED STATES, FREE OF ANY EXPENSE TO THE STATE OF GEORGIA.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2