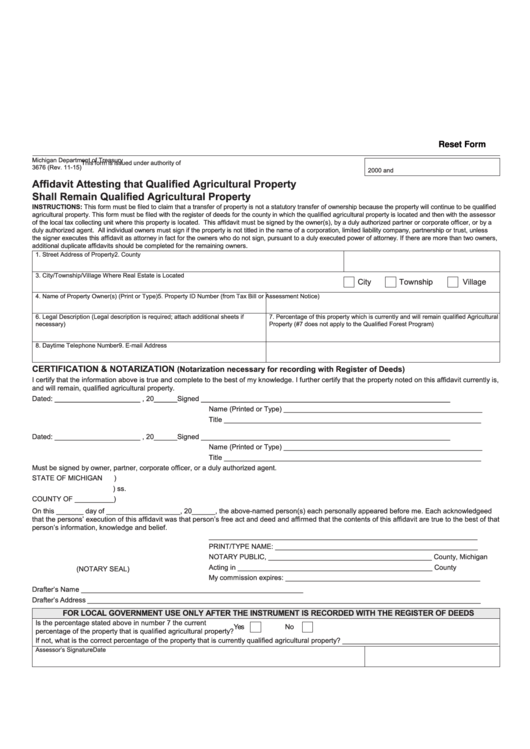

Reset Form

Michigan Department of Treasury

This form is issued under authority of P.A. 260 of

3676 (Rev. 11-15)

2000 and P.A. 378 of 2006. Filing is mandatory.

Affidavit Attesting that Qualified Agricultural Property

Shall Remain Qualified Agricultural Property

INSTRUCTIONS: This form must be filed to claim that a transfer of property is not a statutory transfer of ownership because the property will continue to be qualified

agricultural property. This form must be filed with the register of deeds for the county in which the qualified agricultural property is located and then with the assessor

of the local tax collecting unit where this property is located. This affidavit must be signed by the owner(s), by a duly authorized partner or corporate officer, or by a

duly authorized agent. All individual owners must sign if the property is not titled in the name of a corporation, limited liability company, partnership or trust, unless

the signer executes this affidavit as attorney in fact for the owners who do not sign, pursuant to a duly executed power of attorney. If there are more than two owners,

additional duplicate affidavits should be completed for the remaining owners.

1. Street Address of Property

2. County

3. City/Township/Village Where Real Estate is Located

City

Township

Village

4. Name of Property Owner(s) (Print or Type)

5. Property ID Number (from Tax Bill or Assessment Notice)

6. Legal Description (Legal description is required; attach additional sheets if

7. Percentage of this property which is currently and will remain qualified Agricultural

necessary)

Property (#7 does not apply to the Qualified Forest Program)

8. Daytime Telephone Number

9. E-mail Address

CERTIFICATION & NOTARIZATION

(Notarization necessary for recording with Register of Deeds)

I certify that the information above is true and complete to the best of my knowledge. I further certify that the property noted on this affidavit currently is,

and will remain, qualified agricultural property.

Dated: ______________________ , 20______

Signed ________________________________________________________________

Name (Printed or Type) ___________________________________________________

Title __________________________________________________________________

Dated: ______________________ , 20______

Signed ________________________________________________________________

Name (Printed or Type) ___________________________________________________

Title __________________________________________________________________

Must be signed by owner, partner, corporate officer, or a duly authorized agent.

STATE OF MICHIGAN

)

) ss.

COUNTY OF __________)

On this _______ day of ___________________, 20______, the above-named person(s) each personally appeared before me. Each acknowledgeed

that the persons’ execution of this affidavit was that person’s free act and deed and affirmed that the contents of this affidavit are true to the best of that

person’s information, knowledge and belief.

_____________________________________________________________________

PRINT/TYPE NAME: ____________________________________________________

NOTARY PUBLIC, __________________________________________ County, Michigan

Acting in __________________________________________________ County

(NOTARY SEAL)

My commission expires: __________________________________________________

Drafter’s Name _________________________________________________________

Drafter’s Address _____________________________________________________________________________________________________

FOR LOCAL GOVERNMENT USE ONLY AFTER THE INSTRUMENT IS RECORDED WITH THE REGISTER OF DEEDS

Is the percentage stated above in number 7 the current

Yes

No

percentage of the property that is qualified agricultural property?

If not, what is the correct percentage of the property that is currently qualified agricultural property? ________________________________________

Assessor’s Signature

Date

1

1 2

2