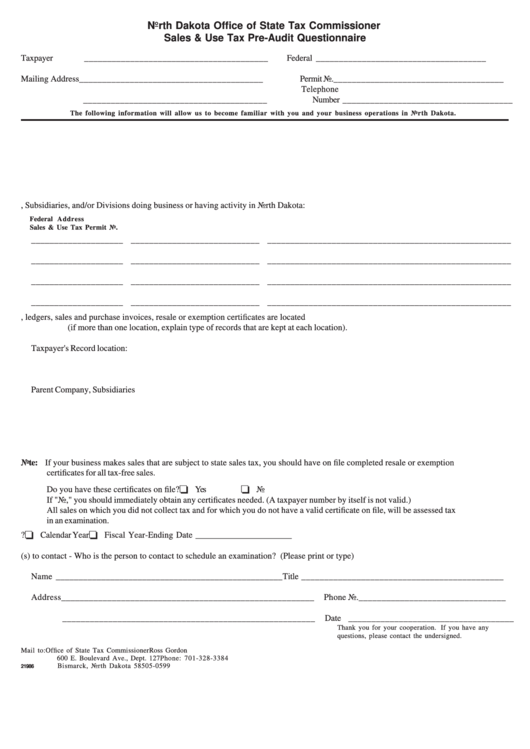

North Dakota Office of State Tax Commissioner

Sales & Use Tax Pre-Audit Questionnaire

Taxpayer

________________________________________

Federal I.D. No. _____________________________________

N.D. Sales/Use Tax

Mailing Address ________________________________________

Permit No. _____________________________________

Telephone

________________________________________

Number _____________________________________

The following information will allow us to become familiar with you and your business operations in North Dakota.

1. Business Operation - Give a general description of your business activity in North Dakota.

2. List Parent Company, Subsidiaries, and/or Divisions doing business or having activity in North Dakota:

Federal I.D. No. and N.D.

DBA

Address

Sales & Use Tax Permit No.

____________________ ____________________________ _____________________________________________________

____________________ ____________________________ _____________________________________________________

____________________ ____________________________ _____________________________________________________

____________________ ____________________________ _____________________________________________________

3. Records - List addresses where records such as journals, ledgers, sales and purchase invoices, resale or exemption certificates are located

(if more than one location, explain type of records that are kept at each location).

Taxpayer's Record location:

Parent Company, Subsidiaries

Note: If your business makes sales that are subject to state sales tax, you should have on file completed resale or exemption

certificates for all tax-free sales.

J Yes

J No

Do you have these certificates on file?

If "No," you should immediately obtain any certificates needed. (A taxpayer number by itself is not valid.)

All sales on which you did not collect tax and for which you do not have a valid certificate on file, will be assessed tax

in an examination.

J Calendar Year

J Fiscal Year-Ending Date ______________________

4. What is your annual accounting period?

5. Person(s) to contact - Who is the person to contact to schedule an examination? (Please print or type)

Name __________________________________________________

Title ____________________________________________

Address _______________________________________________________

Phone No. ________________________________

_______________________________________________________

Date ____________________________________

Thank you for your cooperation. If you have any

questions, please contact the undersigned.

Mail to:

Office of State Tax Commissioner

Ross Gordon

600 E. Boulevard Ave., Dept. 127

Phone: 701-328-3384

Bismarck, North Dakota 58505-0599

21986

1

1