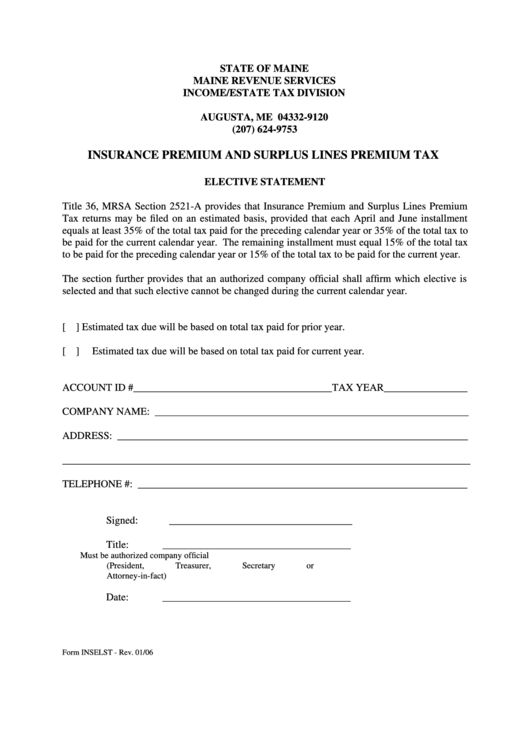

Form Inselst - Insurance Premium And Surplus Lines Premium Tax - Elective Statement

ADVERTISEMENT

STATE OF MAINE

MAINE REVENUE SERVICES

INCOME/ESTATE TAX DIVISION

P.O. BOX 9120

AUGUSTA, ME 04332-9120

(207) 624-9753

INSURANCE PREMIUM AND SURPLUS LINES PREMIUM TAX

ELECTIVE STATEMENT

Title 36, MRSA Section 2521-A provides that Insurance Premium and Surplus Lines Premium

Tax returns may be filed on an estimated basis, provided that each April and June installment

equals at least 35% of the total tax paid for the preceding calendar year or 35% of the total tax to

be paid for the current calendar year. The remaining installment must equal 15% of the total tax

to be paid for the preceding calendar year or 15% of the total tax to be paid for the current year.

The section further provides that an authorized company official shall affirm which elective is

selected and that such elective cannot be changed during the current calendar year.

[ ]

Estimated tax due will be based on total tax paid for prior year.

[ ]

Estimated tax due will be based on total tax paid for current year.

ACCOUNT ID #______________________________________TAX YEAR________________

COMPANY NAME: ____________________________________________________________

ADDRESS: ___________________________________________________________________

______________________________________________________________________________

TELEPHONE #: _______________________________________________________________

Signed: ___________________________________

Title: ____________________________________

Must be authorized company official

(President, Treasurer, Secretary or

Attorney-in-fact)

Date: ____________________________________

Form INSELST - Rev. 01/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1