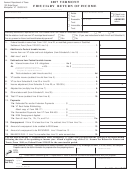

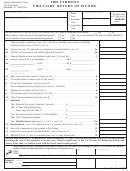

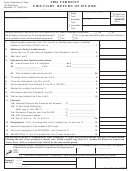

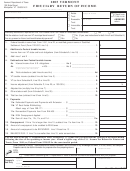

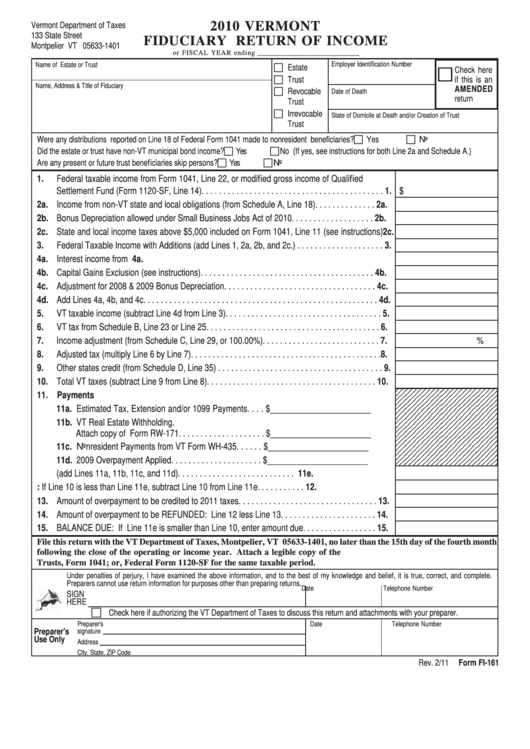

Form Fi-161 - Fiduciary Return Of Income - 2010

ADVERTISEMENT

2010 VERMONT

Vermont Department of Taxes

133 State Street

FIDUCIARY RETURN OF INCOME

Montpelier VT 05633-1401

or FISCAL YEAR ending __________________________

Employer Identification Number

Name of Estate or Trust

Estate

Check here

Trust

if this is an

Name, Address & Title of Fiduciary

AMENDED

Revocable

Date of Death

return

Trust

Irrevocable

State of Domicile at Death and/or Creation of Trust

Trust

Were any distributions reported on Line 18 of Federal Form 1041 made to nonresident beneficiaries?

Yes

No

Did the estate or trust have non-VT municipal bond income?

Yes

No (If yes, see instructions for both Line 2a and Schedule A.)

Are any present or future trust beneficiaries skip persons?

Yes

No

1.

Federal taxable income from Form 1041, Line 22, or modified gross income of Qualified

Settlement Fund (Form 1120-SF, Line 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. $

2a. Income from non-VT state and local obligations (from Schedule A, Line 18) . . . . . . . . . . . . . . 2a.

2b. Bonus Depreciation allowed under Small Business Jobs Act of 2010 . . . . . . . . . . . . . . . . . . . 2b.

2c. State and local income taxes above $5,000 included on Form 1041, Line 11 (see instructions)2c.

3.

Federal Taxable Income with Additions (add Lines 1, 2a, 2b, and 2c.) . . . . . . . . . . . . . . . . . . . . 3.

4a. Interest income from U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a.

4b. Capital Gains Exclusion (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b.

4c. Adjustment for 2008 & 2009 Bonus Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c.

4d. Add Lines 4a, 4b, and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d.

5.

VT taxable income (subtract Line 4d from Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6.

VT tax from Schedule B, Line 23 or Line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7.

Income adjustment (from Schedule C, Line 29, or 100.00%) . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

%

8.

Adjusted tax (multiply Line 6 by Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9.

Other states credit (from Schedule D, Line 35) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Total VT taxes (subtract Line 9 from Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11. Payments

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11a. Estimated Tax, Extension and/or 1099 Payments . . . . $ _______________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11b. VT Real Estate Withholding.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

Attach copy of Form RW-171 . . . . . . . . . . . . . . . . . . . . $ _______________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11c. Nonresident Payments from VT Form WH-435 . . . . . . $ _______________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11d. 2009 Overpayment Applied . . . . . . . . . . . . . . . . . . . . . $ _______________________

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

11e. Total Payments (add Lines 11a, 11b, 11c, and 11d) . . . . . . . . . . . . . . . . . . . . . . . . . . . 11e.

12. Overpayment: If Line 10 is less than Line 11e, subtract Line 10 from Line 11e . . . . . . . . . . . 12.

13. Amount of overpayment to be credited to 2011 taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Amount of overpayment to be REFUNDED: Line 12 less Line 13 . . . . . . . . . . . . . . . . . . . . . . 14.

15. BALANCE DUE: If Line 11e is smaller than Line 10, enter amount due . . . . . . . . . . . . . . . . . 15.

File this return with the VT Department of Taxes, Montpelier, VT 05633-1401, no later than the 15th day of the fourth month

following the close of the operating or income year. Attach a legible copy of the U.S. Income Tax Return for Estates and

Trusts, Form 1041; or, Federal Form 1120-SF for the same taxable period.

Under penalties of perjury, I have examined the above information, and to the best of my knowledge and belief, it is true, correct, and complete.

Preparers cannot use return information for purposes other than preparing returns.

Date

Telephone Number

SIGN

HERE

Check here if authorizing the VT Department of Taxes to discuss this return and attachments with your preparer.

Preparer's

Date

Telephone Number

Preparer's

signature

Use Only

Address

City, State, ZIP Code

Rev. 2/11

Form FI-161

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3