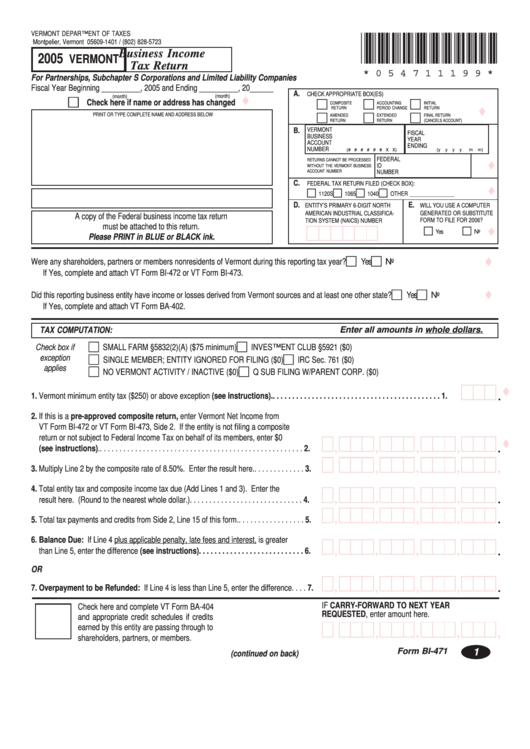

Form Bi-471 - Business Income Tax Return - 2005

ADVERTISEMENT

VERMONT DEPARTMENT OF TAXES

*054711199*

Montpelier, Vermont 05609-1401 / (802) 828-5723

VERMONT Business Income

2005

Tax Return

* 0 5 4 7 1 1 1 9 9 *

For Partnerships, Subchapter S Corporations and Limited Liability Companies

Fiscal Year Beginning __________, 2005 and Ending __________, 20______

A.

CHECK APPROPRIATE BOX(ES)

(month)

(month)

Check here if name or address has changed

COMPOSITE

ACCOUNTING

INITIAL

RETURN

PERIOD CHANGE

RETURN

PRINT OR TYPE COMPLETE NAME AND ADDRESS BELOW

AMENDED

EXTENDED

FINAL RETURN

RETURN

RETURN

(CANCELS ACCOUNT)

B.

VERMONT

FISCAL

BUSINESS

YEAR

ACCOUNT

ENDING

NUMBER

(# # # # # # X X)

(y

y

y

y

m

m)

FEDERAL

RETURNS CANNOT BE PROCESSED

ID

WITHOUT THE VERMONT BUSINESS

ACCOUNT NUMBER

NUMBER

C.

FEDERAL TAX RETURN FILED (CHECK BOX):

1120S

1065

1040

OTHER ________________

D.

E.

ENTITY’S PRIMARY 6-DIGIT NORTH

WILL YOU USE A COMPUTER

GENERATED OR SUBSTITUTE

AMERICAN INDUSTRIAL CLASSIFICA-

A copy of the Federal business income tax return

FORM TO FILE FOR 2006?

TION SYSTEM (NAICS) NUMBER

must be attached to this return.

Yes

No

Please PRINT in BLUE or BLACK ink.

Were any shareholders, partners or members nonresidents of Vermont during this reporting tax year?

Yes

No

If Yes, complete and attach VT Form BI-472 or VT Form BI-473.

Did this reporting business entity have income or losses derived from Vermont sources and at least one other state?

Yes

No

If Yes, complete and attach VT Form BA-402.

TAX COMPUTATION:

Enter all amounts in whole dollars.

Check box if

SMALL FARM §5832(2)(A) ($75 minimum)

INVESTMENT CLUB §5921 ($0)

exception

SINGLE MEMBER; ENTITY IGNORED FOR FILING ($0)

IRC Sec. 761 ($0)

applies

NO VERMONT ACTIVITY / INACTIVE ($0)

Q SUB FILING W/PARENT CORP. ($0)

.

1. Vermont minimum entity tax ($250) or above exception (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. If this is a pre-approved composite return, enter Vermont Net Income from

VT Form BI-472 or VT Form BI-473, Side 2. If the entity is not filing a composite

return or not subject to Federal Income Tax on behalf of its members, enter $0

,

,

,

,

.

(see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

,

,

,

,

.

3. Multiply Line 2 by the composite rate of 8.50%. Enter the result here. . . . . . . . . . . . . . 3.

4. Total entity tax and composite income tax due (Add Lines 1 and 3). Enter the

,

,

,

,

.

result here. (Round to the nearest whole dollar.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

,

,

,

,

.

5. Total tax payments and credits from Side 2, Line 15 of this form. . . . . . . . . . . . . . . . . . 5.

6. Balance Due: If Line 4 plus applicable penalty, late fees and interest, is greater

,

,

,

,

.

than Line 5, enter the difference (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

OR

,

,

,

,

.

7. Overpayment to be Refunded: If Line 4 is less than Line 5, enter the difference. . . . 7.

IF CARRY-FORWARD TO NEXT YEAR

Check here and complete VT Form BA-404

REQUESTED, enter amount here.

and appropriate credit schedules if credits

earned by this entity are passing through to

,

,

,

,

.

shareholders, partners, or members.

Form BI-471

1

(continued on back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2