Form Bls-700-027 - Information For New Registrants - Washington

ADVERTISEMENT

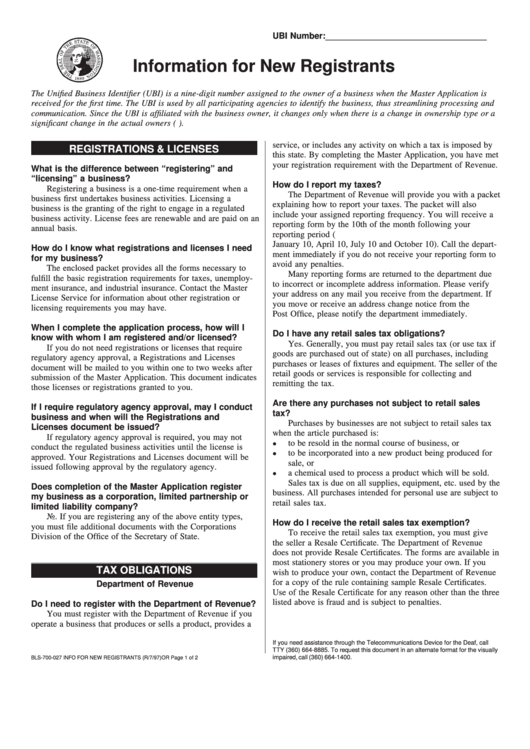

UBI Number: __________________________________

Information for New Registrants

The Unified Business Identifier (UBI) is a nine-digit number assigned to the owner of a business when the Master Application is

received for the first time. The UBI is used by all participating agencies to identify the business, thus streamlining processing and

communication. Since the UBI is affiliated with the business owner, it changes only when there is a change in ownership type or a

significant change in the actual owners (e.g. more than half of the partners in a partnership change).

service, or includes any activity on which a tax is imposed by

REGISTRATIONS & LICENSES

this state. By completing the Master Application, you have met

your registration requirement with the Department of Revenue.

What is the difference between “registering” and

“licensing” a business?

How do I report my taxes?

Registering a business is a one-time requirement when a

The Department of Revenue will provide you with a packet

business first undertakes business activities. Licensing a

explaining how to report your taxes. The packet will also

business is the granting of the right to engage in a regulated

include your assigned reporting frequency. You will receive a

business activity. License fees are renewable and are paid on an

reporting form by the 10th of the month following your

annual basis.

reporting period (e.g. quarterly returns should be received by

January 10, April 10, July 10 and October 10). Call the depart-

How do I know what registrations and licenses I need

ment immediately if you do not receive your reporting form to

for my business?

avoid any penalties.

The enclosed packet provides all the forms necessary to

Many reporting forms are returned to the department due

fulfill the basic registration requirements for taxes, unemploy-

to incorrect or incomplete address information. Please verify

ment insurance, and industrial insurance. Contact the Master

your address on any mail you receive from the department. If

License Service for information about other registration or

you move or receive an address change notice from the U.S.

licensing requirements you may have.

Post Office, please notify the department immediately.

When I complete the application process, how will I

Do I have any retail sales tax obligations?

know with whom I am registered and/or licensed?

Yes. Generally, you must pay retail sales tax (or use tax if

If you do not need registrations or licenses that require

goods are purchased out of state) on all purchases, including

regulatory agency approval, a Registrations and Licenses

purchases or leases of fixtures and equipment. The seller of the

document will be mailed to you within one to two weeks after

retail goods or services is responsible for collecting and

submission of the Master Application. This document indicates

remitting the tax.

those licenses or registrations granted to you.

Are there any purchases not subject to retail sales

If I require regulatory agency approval, may I conduct

tax?

business and when will the Registrations and

Purchases by businesses are not subject to retail sales tax

Licenses document be issued?

when the article purchased is:

If regulatory agency approval is required, you may not

to be resold in the normal course of business, or

!

conduct the regulated business activities until the license is

to be incorporated into a new product being produced for

!

approved. Your Registrations and Licenses document will be

sale, or

issued following approval by the regulatory agency.

a chemical used to process a product which will be sold.

!

Sales tax is due on all supplies, equipment, etc. used by the

Does completion of the Master Application register

business. All purchases intended for personal use are subject to

my business as a corporation, limited partnership or

retail sales tax.

limited liability company?

No. If you are registering any of the above entity types,

How do I receive the retail sales tax exemption?

you must file additional documents with the Corporations

To receive the retail sales tax exemption, you must give

Division of the Office of the Secretary of State.

the seller a Resale Certificate. The Department of Revenue

does not provide Resale Certificates. The forms are available in

most stationery stores or you may produce your own. If you

TAX OBLIGATIONS

wish to produce your own, contact the Department of Revenue

for a copy of the rule containing sample Resale Certificates.

Department of Revenue

Use of the Resale Certificate for any reason other than the three

listed above is fraud and is subject to penalties.

Do I need to register with the Department of Revenue?

You must register with the Department of Revenue if you

operate a business that produces or sells a product, provides a

If you need assistance through the Telecommunications Device for the Deaf, call

TTY (360) 664-8885. To request this document in an alternate format for the visually

impaired, call (360) 664-1400.

BLS-700-027 INFO FOR NEW REGISTRANTS (R/7/97)OR Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2