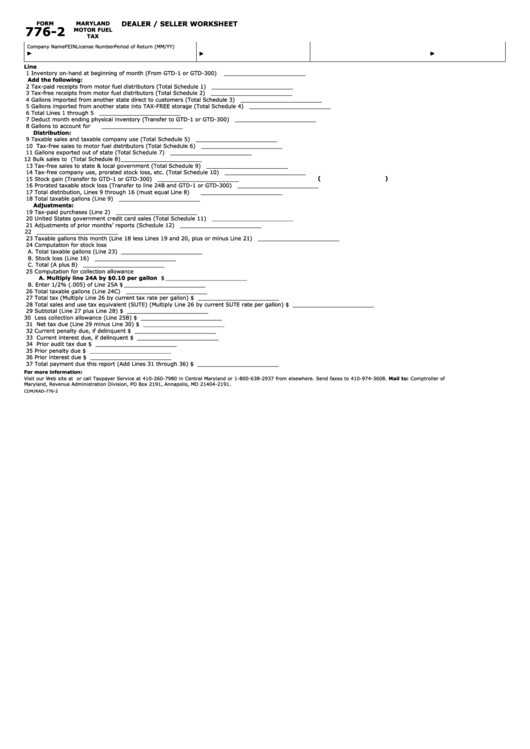

FORM

MARYLAND

DEALER / SELLER WORKSHEET

776-2

MOTOR FUEL

TAX

Company Name

FEIN

License Number

Period of Return (MM/YY)

Line

1 Inventory on-hand at beginning of month (From GTD-1 or GTD-300)

________________________

Add the following:

2

Tax-paid receipts from motor fuel distributors (Total Schedule 1)

________________________

3

Tax-free receipts from motor fuel distributors (Total Schedule 2)

________________________

4

Gallons imported from another state direct to customers (Total Schedule 3)

________________________

5

Gallons imported from another state into TAX-FREE storage (Total Schedule 4)

________________________

6

Total Lines 1 through 5

________________________

7

Deduct month ending physical inventory (Transfer to GTD-1 or GTD-300)

________________________

8

Gallons to account for

________________________

Distribution:

9

Taxable sales and taxable company use (Total Schedule 5)

________________________

10

Tax-free sales to motor fuel distributors (Total Schedule 6)

________________________

11

Gallons exported out of state (Total Schedule 7)

________________________

12

Bulk sales to U.S. government (Total Schedule 8)

________________________

13

Tax-free sales to state & local government (Total Schedule 9)

________________________

14

Tax-free company use, prorated stock loss, etc. (Total Schedule 10)

________________________

(

)

15

Stock gain (Transfer to GTD-1 or GTD-300)

________________________

16

Prorated taxable stock loss (Transfer to line 24B and GTD-1 or GTD-300)

________________________

17

Total distribution, Lines 9 through 16 (must equal Line 8)

________________________

18

Total taxable gallons (Line 9)

________________________

Adjustments:

19

Tax-paid purchases (Line 2)

________________________

20

United States government credit card sales (Total Schedule 11)

________________________

21

Adjustments of prior months’ reports (Schedule 12)

________________________

22

________________________

23

Taxable gallons this month (Line 18 less Lines 19 and 20, plus or minus Line 21)

________________________

24

Computation for stock loss

A.

Total taxable gallons (Line 23)

________________________

B.

Stock loss (Line 16)

________________________

C.

Total (A plus B)

________________________

25

Computation for collection allowance

A. Multiply line 24A by $0.10 per gallon

$ ________________________

B. Enter 1/2% (.005) of Line 25A

$ ________________________

26

Total taxable gallons (Line 24C)

________________________

27

Total tax (Multiply Line 26 by current tax rate per gallon)

$ ________________________

28

Total sales and use tax equivalent (SUTE) (Multiply Line 26 by current SUTE rate per gallon)

$ ________________________

29

Subtotal (Line 27 plus Line 28)

$ ________________________

30

Less collection allowance (Line 25B)

$ ________________________

31

Net tax due (Line 29 minus Line 30)

$ ________________________

32

Current penalty due, if delinquent

$ ________________________

33

Current interest due, if delinquent

$ ________________________

34

Prior audit tax due

$ ________________________

35

Prior penalty due

$ ________________________

36

Prior interest due

$ ________________________

37

Total payment due this report (Add Lines 31 through 36)

$ ________________________

For more information:

Visit our Web site at or call Taxpayer Service at 410-260-7980 in Central Maryland or 1-800-638-2937 from elsewhere. Send faxes to 410-974-3608. Mail to: Comptroller of

Maryland, Revenue Administration Division, PO Box 2191, Annapolis, MD 21404-2191.

COM/RAD-776-2

1

1